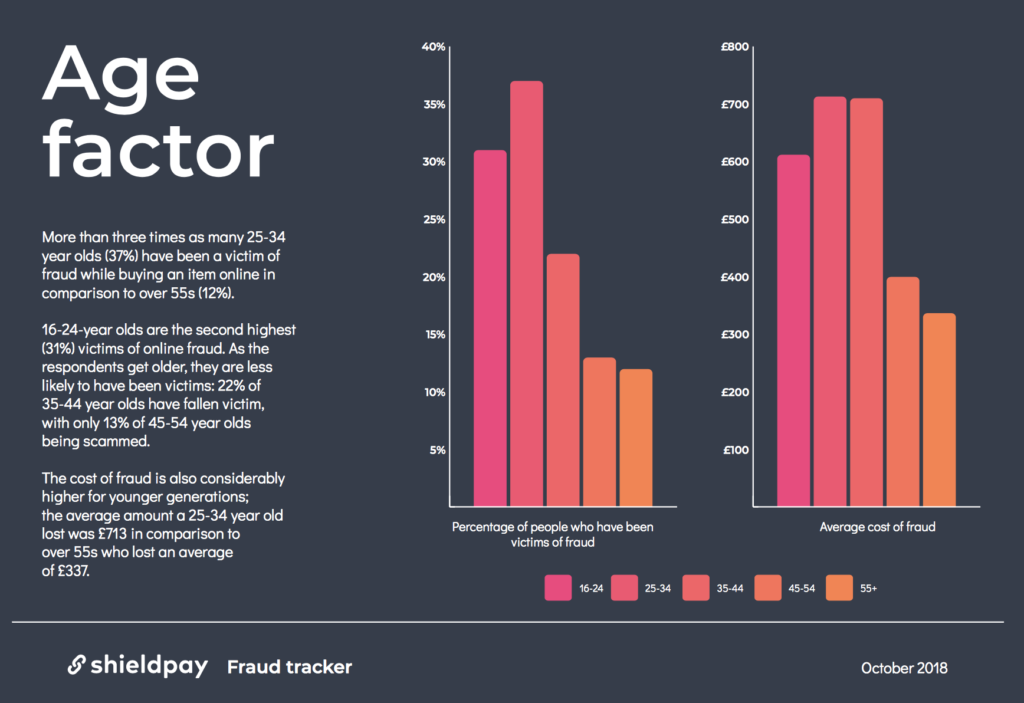

Despite the common assumption that the younger generation is more tech-literate, three in 10 (31%) 16-24-year olds have been a victim of online shopping fraud, compared with only 12% of over 55s according to secure payments provider Shieldpay.

Younger victims of online fraud are also facing more significant losses compared to older victims. Those aged between 16-24 who were scammed whilst purchasing an item online lost on average £613, compared to those aged 55 and above losing £337, a difference of £276.

Here’s a summary of the stats Shieldpay discovered:

Not only are younger generations losing more than their elders, banks are also recovering less than for the generations above them. On average, 16-24-year olds have 42% of the money they lost returned to them by their bank or payment provider, whilst those aged 55 and over managed to recover 77% of their money. Interestingly, 65% of the elder generation reported that they were able to recover the full amount, compared to just 21% of those aged between 16 and 24.

It appears that the less cautious approach taken by younger generations online could be a cause of this disparity. Far more over 55s are uncomfortable with transferring money to a stranger via online bank transfer compared to the younger generation. Seven in 10 (71%) of those aged over 55 would not transfer any amount of money to a stranger online, compared with only three out of 10 (29%) aged 16-25.

This less cautious approach by young Brits is also reflected in the amount each age group would be happy to transfer online via bank transfer to a stranger. Young Brits are willing to transfer £85 more on average than those over 55, which can go some way to explaining how they are losing out more when they do fall victim to an online scammer.

Tom Clementson, Director of Consumer & SMB at Shieldpay, said:

“It’s often thought that older people are most at risk from fraud, yet it is the younger more tech savvy generation that are being deceived more often. Common stereotypes need to be rejected, banks and businesses have a large part to play in ensuring vulnerable consumers are protected online. That said it is still crucial that people stick to safe practice and be vigilant when buying and selling online.â€