The Telegraph recently ran a piece on the state of peer-to-peer lending (sometimes called P2P lending or social lending) in the UK, looking at the following companies from this new breed of lender:

How does peer-to-peer lending work?

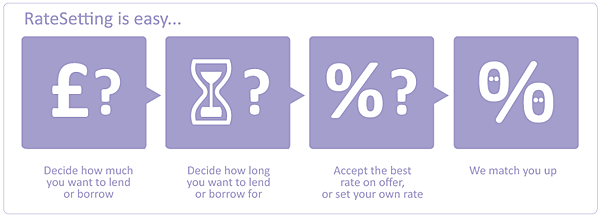

The aim of peer-to-peer lending is to cut out the middleman (usually banks). You can lend your money almost directly to one (or more sensibly, several) borrowers, in most cases this is other individuals, although in the case of Funding Circle, it’s small businesses.

All borrowers or companies are checked out, for example with credit checks, and given a risk rating – those deemed most risky, and therefore most likely not to pay back their loan, will have to pay a higher interest rate, and could potentially make you more money. Or you could lose it all.

By spreading your risk, which is an inherent part of most of these companies’ models, you can mitigate the chances of losing all of your money.

Industry in its infancy

Whilst Zopa has been in business for 5 years (and is by far the most established peer-to-peer lender in the UK), the others on the list above have all started business this year, so most of the industry is still very much in its infancy. That means there’s still a lot of learning to be done into the level of risk you’ll be exposed to when lending your money.

On the other side of the equation, peer-to-peer lending can potentially offer a lower rate to those looking for an affordable loan.

I’ve put together a Google Spreadsheet which rounds up the features of all the peer-to-peer lenders, and we’ll keep this updated to see how the industry matures.

It’s worth remembering that this type of lending is currently unregulated, and whilst the returns might look tempting, there is a reasonable amount of risk.

Have you used one of the peer-to-peer lenders to lend or borrow money? Let us know your experiences in the comments below.