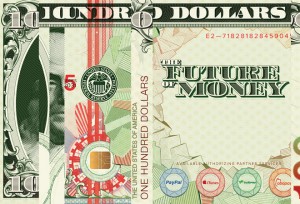

Wired recently published an article entitled “The Future of Money: It’s Flexible, Frictionless and (Almost) Free” which is worth a read, if you have a spare 20 minutes.

Whilst the article briefly discusses a few innovative payment systems, such as Square and TwitPay, it largely focuses on PayPal, going into some of its history, how it innovated by opening up to developers, but actually begins to look like an advertorial for the payment company.

But the article’s real value is in the comments, which largely dispell the authors ideas that PayPal is a cheap way of processing payment compared with credit card companies and banks.

Wow! – this article got me all excited about how to get back at the greedy financial institutions. Move Your Money is a great idea, but shortcutting the bankers multiple fees sounded even better, until I checked out Twitpay’s website – Powered by Paypal, “The recipient of the payment will be required to pay PayPal’s commercial transaction fee of 2.9% + 0.30 USD and any other applicable fees.†Whoa, is this a race to see who can charge the HIGHEST fees?

It’s true that PayPal has pushed the boundaries of payment by opening up its infrastructure – or perhaps it’s the developers using their infrastructure that are really the innovative ones – but they still seem to charge a high price for this freedom.

As we mentioned yesterday, fees threaten to hold (mobile) payment processors back.