Earlier this year, the Financial Times published an article highlighting the financial plight of millennials, capturing the mood of the nation and provoking a media storm. It had a familiar refrain: young people aren’t saving enough for the future. Generation Y’s bleak financial prospects seem to be practically axiomatic these days – but it doesn’t have to be this way.

Big banks, the Fintech industry and the government are all aware of the negative relationship millions of people have with money, and they’re all out to fix it. In August, the Competition and Markets Authority (CMA) published the findings of an in-depth retail banking investigation. The report announced a host of urgent changes and laid out the future of banking, with a vision based on open APIs and data sharing.

Chip is the new “millennial-friendly” automatic savings app which shows us how this brave new world could look. It claims to be the first of its kind to focus on young people’s greatest challenge: saving. Created by serial app entrepreneur Simon Rabin, with a team based in the Level39 Fintech accelerator in Canary Wharf, Chip has come out of the heart of London’s financial centre.

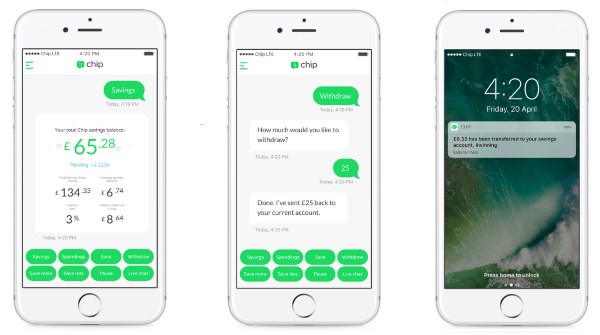

Chip connects to the user’s online banking, analyses their spending and calculates how much they can afford to save without having an impact on their day-to-day spending. That money is then automatically moved into their Chip savings account.

Alasdair Smith, Chair of the CMA investigation, said:

“Consumers sharing their banking data with third parties has the potential to transform competition in retail banking markets.†He added: “We want customers to be able to access new and innovative apps which will tailor services, information and advice to their individual needs.†Chip is the first working example of such an app in the UK, giving us a glimpse of the future of banking.

Chip was created in response to the clear need for change in the ways young people manage their money. Life is expensive, spending is seamless and banks don’t do anything meaningful to help their customers save. Rabin said:

“Chip’s mission is to make saving money as effortless as spending it. We used to find it really hard to calculate how much we should be saving each month and didn’t have the discipline to actually put it away. That’s why we made Chipâ€

“We know young people dread checking their bank balance – research shows 21% of millennials have gone into an unarranged overdraft and paid through the nose for it. Our long term mission is to help millennials get their finances in better shape without being judgmental, patronising or annoying†he added.

The chatbot interface not only positions the app perfectly for Facebook Messenger’s new Bot Store but also enables Chip to communicate with users via friendly, informal messages and enthusiastic use of emojis and GIFs. This establishes a positive relationship between Chip and its users, and between users and their money. Co-founder Nick Ustinov says: “we’ve seen 64% conversion from install to account creation – that’s double anything I’ve seen before using a traditional GUIâ€. For examples of the user interface, click here.

Young people who want to save money are currently limited by poor service from banks. 45% of adults under the age of 30 say technology plays an important role in managing their money and 43% use apps for day to day banking (YouGov). There aren’t currently any equivalent tools to empower people to save more money. That’s where Chip steps in.

Chip takes a few minutes to set up, compared to the arduous task of switching banks to get a better service. Just 3% of people switched bank accounts in the last 12 months; 120,000 fewer than the year before, despite the new Current Account Switching Service. 23% of millennials say they would never switch regardless of what they were offered or how much money they could save. With Chip, the user can access a fantastic new service in a matter of minutes.

A Chip savings account, where a user’s money is held, is a virtual account in the user’s name held at Barclays. Currently Chip accounts are provided by Prepaid Financial Services Ltd, which is authorised and regulated by the FCA with an e-money licence (FCA reference number 900036). Chip Financial Ltd aims to get FSCS accreditation in 2017.

Chip is available to download now in the App Store and Google Play. Saving is just the start – Chip are promising that there is a lot more functionality to come including a range of “carefully tailored financial services at better rates than the banks”.

Chip is currently available only in the UK and works with the following banks:

- Barclays

- Lloyds

- Natwest

- Nationwide

- RBS

- TSB

- Halifax

- First Direct.

Our verdict

My first concern with the app was the need for connecting it to your bank account so that it can analyse your spending and then crucially, make transactions – however, Chip doesn’t actually need to store your login details, and the transactions are made via Direct Debit, so it’s safer than I first thought.

There also appear to be no fees, so the cost is also something you won’t need to worry about.

The success or failure of Chip will depend on how well its algorithm works to identify when you have spare money to save – you don’t want it squirreling money away that you’ll need (although there are no fees for getting your money out of the Chip savings account). In fact, Chip are so confident in their algorithms ability to calculate exactly how much you can afford to afford to save that if Chip transfers an amount that causes you to go in to overdraft, they’ll replace the money immediately, pay your bank’s charges and deposit a £10 savings bonus to your account.

A similar savings app, Plum, is due to launch shortly.