According to a recent study, our brains set aside rationality when we listen to supposedly expert advice.

Makes sense doesn’t it? After all, expert advice is supposed to take away the difficulties we have in understanding a subject.

Of course, what each person considers as expert advice will differ – some will have a financial adviser who they trust as being an expert, others will see their bank manager in a similar light. And right now, many will consider Martin Lewis to be an expert in his field.

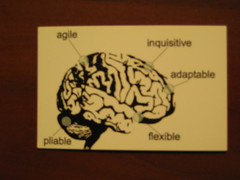

…the brain tends to abdicate responsibility and defer to their authority with little independent thought, a study has suggested. Such expert advice suppresses activity in a neural circuit that is critical to sound decision-making and value judgments, scientists in the US have found. Their results may explain why people are so apt to follow experts’ recommendations blindly, when a little reflection might be sufficient to suggest an alternative course of action.

And during the current economic turbulence, this is likely to be even more the case than normal.

So should we mistrust all financial experts and their advice, or try to look after our finances without any help?

Of course not, but it definitely pays to make sure your brain is switched on when taking advice. If there’s something you don’t understand or something you don’t think is right, question it. In such situations, boredom and fear can takeover, but you need to have a clear yet questioning mind to get the best outcome in these situations. And if you employ an expert with the necessary qualifications and regulation, then there is always a course of redress if you believe you’ve been given blatantly bad advice.