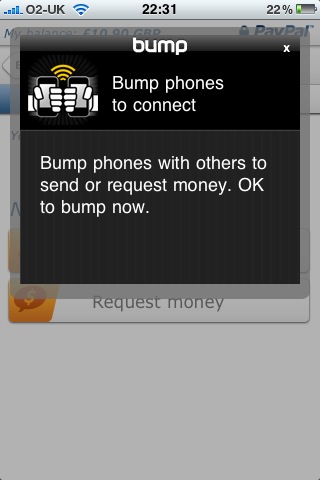

Meghan Keane at eConsultancy has some thoughts on PayPal’s new iPhone app which features Bump technology to allow users to transfer money quickly between iPhones.

Her view is that a well established payment provider such as PayPal is more likely to be widely accepted rather than a brand new service such as Square (a bit of hardware that attaches to your iPhone to accept card payments), but that the fees PayPal charges could hold it back.

Both Square and PayPal take a cut of of the money that gets paid through their services. PayPal takes a percentage of every transaction. It’s free to send money with a bank account, but credit card payments are subject to a fee executed by PayPal. Meanwhile, if users want to access the money they’ve been paid through the service, PayPal also takes a cut — usually 2.9%… as long as people have to pay a fee to access money they’ve been paid with a mobile phone, rumors of this sort of thing replacing cash will be highly exaggerated.

We’ve seen from the experience of charging ATMs that people do indeed hate to get their hands on their own money, regardless of whether they appreciate that some of these services do not come for free.