Google has been testing various financial comparisons in its search results for a while, and today it has rolled out the results of those trials into a single site; Google Advisor.

Financial decisions may be some of the most difficult decisions we face—whether it’s finding the right credit card or understanding the impact of paying an extra point on a mortgage. And these days, it seems like we have more financial options than ever.

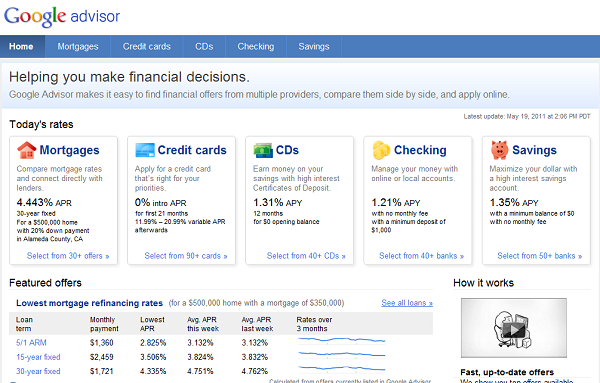

To help solve these problems, we began testing a mortgage comparison tool in 2009 and have added other financial products such as credit cards, CDs, checking, and savings accounts. Today, we’re rolling these tools into one place: Google Advisor, a site designed to help you quickly find relevant financial products from many providers and compare them side-by-side.

Google Advisor is currently only available in the U.S., but it perhaps points to the direction that Google is moving to with financial comparisons. Google’s testing of financial comparisons in its search results have always been a little half-hearted, providing little for the big comparison sites to worry about.

But it’s worth remembering that Google purchased UK comparison site BeatThatQuote a couple of months ago (by the way, they’re still not appearing in the natural Google search results for their own name, following a Google penalty to violating their terms of service), so they may be gearing up for a more concerted push into this market. As we’ve said before, they will have to find the right balance between developing their own comparison tool and annoying some of their very large Adwords spenders.

The products it covers are mortgages, credit cards, CDs, checking (current) accounts and savings accounts. Google is paid commission on some of the products, although on others they claim they are not currently making any money.

You can see how Google Advisor works in this video:

What do you think about Google getting into financial comparisons? Should the big comparison sites be worried, or is this another example of Google trying to get into a market that it doesn’t fully understand? Let us know in the comments below.