MoneyWeek has posted some pretty interesting evidence to suggest that now still might not be the right time to start buying properties again, and that house prices could fall even further in the near future, despite there being a few more positive signs in the housing market in recent weeks.

There have apparently been an increase in house viewings since the start of the year, which has got a few estate agents excited (those who haven’t yet left the industry or gone out of business).

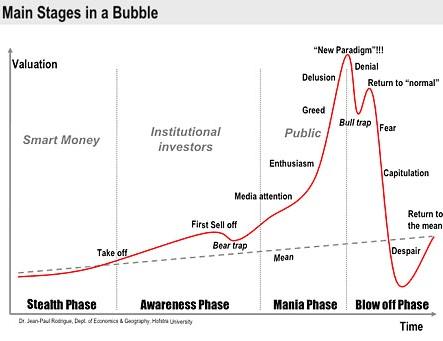

But MoneyWeek are suggesting that the UK housing market is showing a very similar trend to the graph shown in economist Dr. Rodrigue‘s Mania and Bubbles chart, which shows the main stages in a bubble:

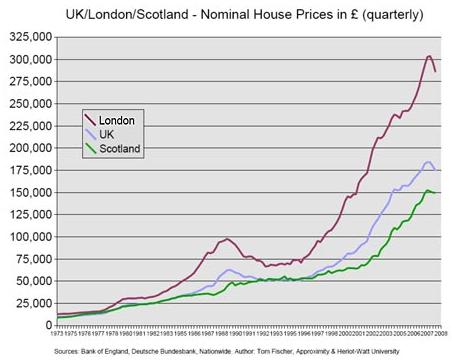

Compare the shape of that graph to a chart of the UK property market since 1973:

Notice the similarities? We’re probably experiencing the denial stage, with the “bull trap” just around the corner, which could well catch a few buyers out.

Of course, theory is a wonderful thing, but it does make quite a compelling case to stay out of the property market for a while to come. Or will analysing these things in such detail just perpetuate the problem?

It’s all worrying news, but you have to wonder how much of it is plain old scaremongering.

That said, I’ve seen my pension take a nose dive recently and my house is valued at its lowest price in years. Things can only get better!

It really all depends on the time-scale of the graph. I would say that graphs and charts don’t measure fundamental values…look at price-to-rents and price-to-incomes. Those are more telling.

On another note…if anyone’s looking for a $6,000 3-bdrm house in Detroit???

http://www.planbeconomics.com/2009/03/11/looking-for-a-6000-3-bdrm-house/

I agree. Our economy has relied too heavily on credit/ debt for the past few decades. Although govt’s are picking up the slack by increasing their debts it will not make up for the deleveraging in private households…and this is what will cause a significant drop in house prices.

Both Professor Robert Shiller and Professor Steve Keen discuss these issues in great detail.

Its not really worrying because really which one of you wants to carry a $500K mortgage for a simple 3 bedroom home?

While making 40K or 80-100K combined, you might as well become a slave to the house at that point.

I think it is very necessary for the prices to adjust to real values.

Hi, Your missing the point… We have had boom times based on unsustainable debt, It wasn’t real, It wasn’t earned!… Now all that bad debt has to be written off and its going to be paid for via the government and market forces deliberately devaluing every single asset class including real estate to a level it should be in reality as opposed to the unreal world valuations of the fake financial bubble… The over indulgence and greed must be paid for and we are all now going to be paying the massive bill via loss of value in the pound, Our savings, Our retirement accounts, Our stocks and bonds and yes, Our real estate!.. We will see about another 45% drop in real estate values but this will take a long time because people who now own property wont want to accept this new reality. The economy will be reset to pre-bubble valuations and you can bet it will over correct!.. It wont be pretty.

Interesting and possibly correct except have you seen this appearing on the same ‘hallowed’ pages?

http://money-watch.co.uk/484/average-house-price