In today’s fast-paced world, managing finances can be a daunting task. However, with the advent of open banking, budgeting and saving have become more streamlined and efficient. Open banking allows third-party financial service providers to access your banking information securely, enabling a new wave of innovative apps designed to help you manage your money better. Here, we explore some of the best budgeting and saving apps that leverage open banking to help you achieve financial freedom.

What is Open Banking?

Open banking is a system that provides third-party financial service providers access to consumer banking, transaction, and other financial data through the use of application programming interfaces (APIs). This system aims to provide more financial transparency options for account holders, ranging from open data to private data.

Top Budgeting and Saving Apps

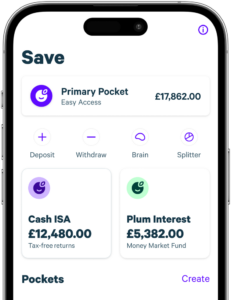

Plum – Plum is an AI-powered app that helps you save money automatically. By analyzing your spending habits, Plum sets aside small amounts of money that you won’t even notice are gone. It also offers investment options, allowing you to grow your savings over time.

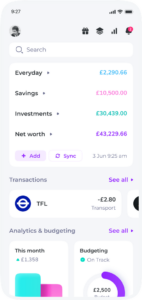

Emma – Emma is a personal finance app that connects to your bank accounts and helps you track your spending. It categorizes your expenses, identifies wasteful subscriptions, and provides insights into your financial habits. Emma is perfect for those looking to get a clear picture of their finances.

Moneyhub – Moneyhub offers a comprehensive view of your finances by aggregating all your accounts in one place. It provides detailed analytics and insights, helping you make informed financial decisions. Moneyhub is ideal for those who want to dive deep into their financial data.

Snoop – Snoop is an app that provides personalized money-saving tips based on your spending patterns. It uses open banking to analyze your transactions and offers suggestions on how to save money on bills, subscriptions, and everyday expenses.

Benefits of Using Budgeting and Saving Apps

- Automated Savings: These apps can automatically set aside money based on your spending habits, making saving effortless.

- Expense Tracking: By categorizing your expenses, these apps help you understand where your money is going and identify areas where you can cut back.

- Financial Insights: With detailed analytics, you can gain a better understanding of your financial health and make informed decisions.

- Personalized Tips: Apps like Snoop offer tailored advice on how to save money, helping you make the most of your income.

Open banking continues to revolutionise the way we manage our finances. Whether you’re looking to save more, track your expenses, or gain insights into your financial habits, there’s an app out there for you.