Here, we explore some of the best budgeting and saving apps that leverage open banking to help you achieve financial freedom.

Tag: saving

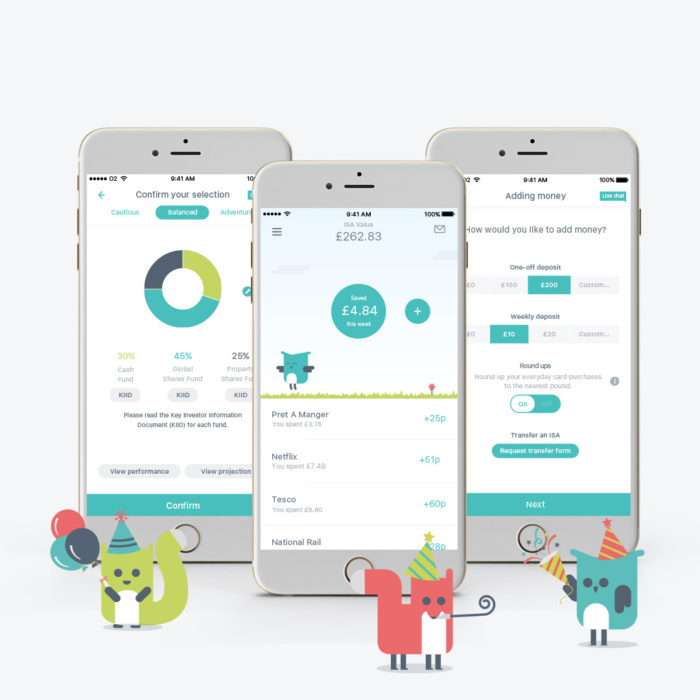

Moneybox: Save & Invest With As Little As £1

Mobile app Moneybox has launched with the aim of allowing users to easily save and invest with as little as £1.

How Much Is Your Electricity Costing You Right Now?

If you’ve ever wondered how much the electricity you’re using in your home is costing you minute-by-minute then GoCompare’s real-time electricity calculator will help give you an idea.

Unshackled.com: Antidote To Rip-Off Mobile Phone Contracts?

A new website has launched which aims to end rip-off mobile phone contracts by splitting the phone and SIM purchase and monitoring the best deals from month to month.

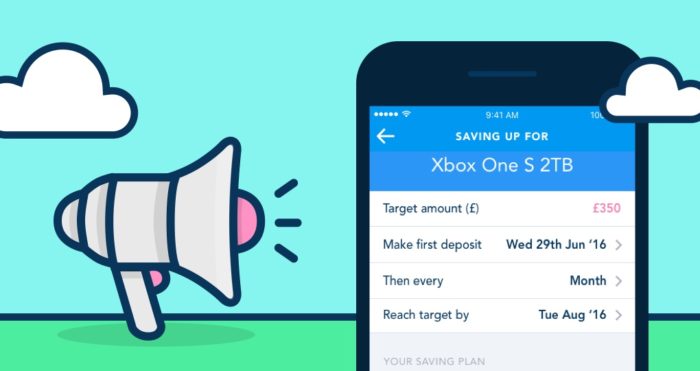

Saving App PiggyPot Goes Public

PiggyPot, a new saving app for iOS, has launched on the app store in “public beta”, which allows users to start using the app for real and to provide feedback to the developers, highlighting issues and suggesting future functionality.

goHenry’s New Features Aim To Make Saving A Habit For Young People

goHenry – the family banking tool that empowers young people between the ages of 8 and 18 to save, spend and learn about money – has announced a new feature which aims to help children and teens to easily budget and save.

PKTMNY: Online Pocket Money & Savings For Kids (Controlled By Parents)

PKTMNY is a new way for parents to help their children earn, save and spend their money.

OrSaveIt: App Encourages Saving, Not Spending

According to OrSaveIt, the average person spends almost £3,000 each year on impulse purchases. So they’ve built an iPhone app they hope will encourage us to stop all the impulse spending.

Why Are Some People Better At Managing Money? It’s All In Your Brain

The ability to save money is determined by the side of the brain you think with, according to research carried out by First Direct bank.

Struggling To Save? This Analogy Probably Won’t Help You…

Let’s face it, saving money is hard. If you’re lucky enough to have something left at the end of the month the chances are you’d prefer to fritter it away on booze or gadgets rather than putting it aside for a rainy day.