The Telegraph recently ran a piece on the state of peer-to-peer lending (sometimes called P2P lending or social lending) in the UK, looking at the following companies from this new breed of lender:

How does peer-to-peer lending work?

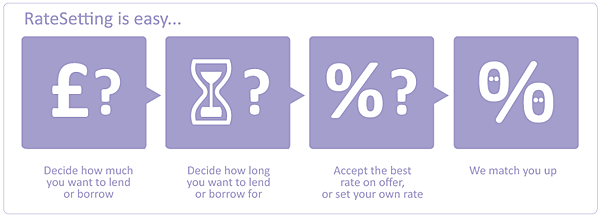

The aim of peer-to-peer lending is to cut out the middleman (usually banks). You can lend your money almost directly to one (or more sensibly, several) borrowers, in most cases this is other individuals, although in the case of Funding Circle, it’s small businesses.

All borrowers or companies are checked out, for example with credit checks, and given a risk rating – those deemed most risky, and therefore most likely not to pay back their loan, will have to pay a higher interest rate, and could potentially make you more money. Or you could lose it all.

By spreading your risk, which is an inherent part of most of these companies’ models, you can mitigate the chances of losing all of your money.

Industry in its infancy

Whilst Zopa has been in business for 5 years (and is by far the most established peer-to-peer lender in the UK), the others on the list above have all started business this year, so most of the industry is still very much in its infancy. That means there’s still a lot of learning to be done into the level of risk you’ll be exposed to when lending your money.

On the other side of the equation, peer-to-peer lending can potentially offer a lower rate to those looking for an affordable loan.

I’ve put together a Google Spreadsheet which rounds up the features of all the peer-to-peer lenders, and we’ll keep this updated to see how the industry matures.

It’s worth remembering that this type of lending is currently unregulated, and whilst the returns might look tempting, there is a reasonable amount of risk.

Have you used one of the peer-to-peer lenders to lend or borrow money? Let us know your experiences in the comments below.

a good idea and a very useful one…

I’m currently lending through Zopa, which is a fairly well established site. There are some issues with the service, notably the processing times that are taken for funds to be lent and for interest to accrue, typically about a week. However the service is very personal, with full profiles and details of most borrowing available.

If your a lender, I would recommend starting small however, there is the potential to forget that a single bad debt will wipe out all of your profits fairly quickly, despite the authors spreadsheet that only £10 goes to each borrower, this is not true. If you make a direct loan offer, you can lend a single individual the full value if their requested loan, and subsequently loose all of it.

“despite the authors spreadsheet that only £10 goes to each borrower, this is not true. If you make a direct loan offer, you can lend a single individual the full value if their requested loan, and subsequently loose (sic) all of it.”

This is not accurate. There is the ability to limit your exposure to £10 but you must ensure that it is this figure (it can be higher). Indeed it would be foolish to lend any given borrower the full amount.

Been lending on Zopa to over 250 people for over 18 months now. 3 have defaulted (not surprising given the state of the nation). There’s more information on defaulters for lenders than you can shake a stick at. Overall I’m doing a darn sight better than the banks are offering, and my investment is easily outperforming inflation – even allowing for defaulters. Leave it in the bank and your capital is being eroded in favour of those who still take £ms in bonuses – which is your money which should be in your pocket.

useful spreadsheet on peer to peer lending as it was in 2010. Has there been an update. I am trying to find out more about Funding Circle and Thincats.com without relying only on their own web sites

I’d definitely use zopa these days. The marketplace on there is huge now and the terms are great for borrowers and lenders get a good return on money after bad debt so its been a real winner. Just shows what can hapopen in 2 years!