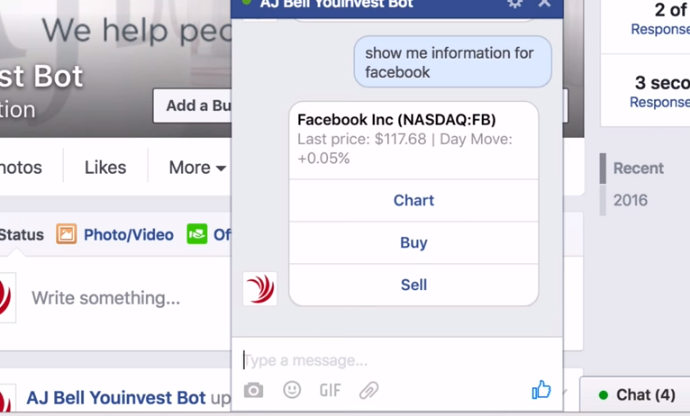

Investment platform / stockbroker AJ Bell has recently published a video showing a demo of how their clients may in future be able to trade shares via Facebook Messenger.

In the video, the Facebook user sends messages to the AJ Bell bot, which uses artificial intelligence to interpret the messages, and then replies with either information or to prompt the user to take action. In this particular example, the user gets a valuation of their accounts, and then actions a deal for £500 worth of Facebook shares, all through the Messenger app.

This got me thinking whether this type of interaction with a “bot” could be the future of banking? The same software could be used by banks to allow you to quickly check your balance, or to make a transfer to a friend, or to pay a bill – this could be done within their existing online banking platforms, but equally, as with this demo, it could find its way onto the social networks. For many, this will be a far more convenient channel, as it’s where they spend most of their time online. Whilst the demo is done on Facebook on a desktop PC, it would also translate nicely to mobile devices.

What about security? Well, this is a big concern, but there’s no reason this obstacle can’t be overcome. In the AJ Bell demo, they’re using 2-factor authentication (a code sent via text to the user’s registered mobile number) to add an extra layer of security.

Watch the demonstration for yourself, below.

What do you think, do you think we’ll soon be tweeting our banks or connecting with our brokers on Facebook? How do you feel about interacting with a bot? Let us know in the comments below.