Britons are using the internet and doing their own calculations when starting to plan their finances.

An independent survey for HSBC reveals that almost half (45%) of Britons use official websites to help consider what savings, investments and insurance they might need, compared to 29 per cent who speak to a professional financial adviser.

Nearly half (47%) do their own calculations, ahead of speaking to their friends and family (39%).

This ‘do-it-yourself’ approach emerged from an HSBC survey of over 17,000 people in 17 countries across five continents about their sources of advice for financial planning.

The bank found Britons’ preference for internet advice via use of official websites (45%) was one of the highest of all countries surveyed and far higher than the international average (34%).

Only the UAE at 47 per cent and China and Malaysia (both 46%) were higher, while Mexico, Canada, France and the USA lagged behind (22, 26, 27 and 29 per cent respectively).

The HSBC survey is part of The Future of Retirement, which explores changing attitudes towards retirement and financial planning around the world. Today’s figures are released ahead of the latest report The Future of Retirement: Why family matters, which will be published later this month.

The results also found nearly 1 in 4 Britons (23%) use internet forums, chat rooms and blogs to access opinions and advice from other internet users, in addition to researching mainstream websites.

Christine Foyster, Head of Wealth Development at HSBC, said:

“It is remarkable the UK is the only country we surveyed where people are more likely to visit a website than speak to their family when it comes to financial planning, opting for the anonymity and convenience of the online space.

“It is a powerful indicator of how much habits have changed, and we need to make sure that we are catering for the click-through-consumer in how we offer information and advice.”

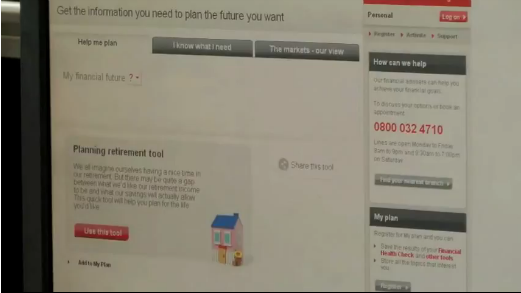

To help meet this need HSBC has launched an online Planning retirement tool to help people determine whether they are saving enough money to enjoy the retirement they envisage.

One positive aspect of the findings is that the internet is fuelling greater financial engagement among younger consumers.

While the over 50s are more likely to seek professional financial advice than younger age groups, people in their thirties are more likely than older people to conduct research online – particularly via informal channels such as blogs and forums.

Nearly a fifth (18%) of people aged 50-59 use informal online research, including blogs and forums, to research financial decisions, falling to 13% of the over 60s. This compares to 28 per cent of those in their 30s.

Christine Foyster added:

“The internet is helping to foster a ‘Do-It-Yourself’ attitude among younger people, encouraging them to start planning earlier. However, while online information and tools are useful, we would always recommend that people take professional financial advice before putting their plans into action.”

The report also revealed a gender gap in ‘DIY’ financial planning. Men are more likely to make their own calculations than women (49% versus 44%). However women are more likely to seek guidance from family or friends: (47% of women v 33% of men).

The findings indicate greater levels of confidence among men when it comes to making financial decisions. While less than one in seven men (16%) described their level of experience in managing their finances as basic, the figure for women was one in five (21%).

Sometimes, the programs themselves are flawed, or they rely on financial predictions they don’t disclose. And even when the program is relatively sound and transparent, the more potentially accurate the output, the more complex the input requirements, resulting in an experience that turns out to be sadly subject to user error.