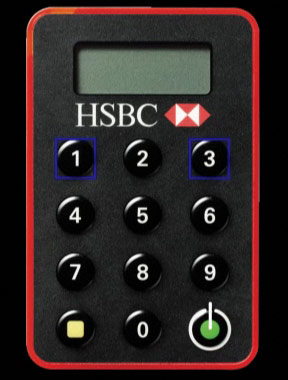

HSBC are sending out their new Secure Key devices to improve security for their Personal Internet Banking customers.

The device, which happens to look like a cheap calculator from the 1980’s, generates a random PIN that you have to enter when logging on to your HSBC account. If you connect to your office network when you’re away from the office the chances are you have to carry around a “dongle” which does a similar thing.

HSBC say the benefits of the device are:

- Enhanced security – Criminals can steal or guess a password. But with Secure Key, they need your PIN number AND your personal Secure Key device to log onto your Personal Internet Banking. It’s an extra layer of security.

- Easy to use – Just switch it on, enter your Secure Key PIN code and it’ll give you a unique, one-off six digit passcode each time you want to log on. It’s as simple as that.

- Small and portable – It’s about the same size as a credit card so it should easily fit in a wallet or purse. You can take it with you and log on to your bank account anywhere you like.

It’s good to see they’re taking security seriously, but I’ve always had a feeling that these devices tend to provide more of a barrier to logging in than it’s worth for the extra security they provide.

If the best banks can somehow find a way of using mobile phones, which we’re all likely to have with us wherever we are, and have more of an attachment to than a cheap looking piece of plastic, to replace these devices then both security and customer engagement should increase.

It will also be interesting to see how well account aggregators which require login details to access accounts will cope with this extra level of security.

HSBC will start sending Secure Keys out to new customers from March 23rd, with existing customers due to receive theirs in the coming months.

If you’re a HSBC customer, how do you feel about having this extra level of security? Pleased that it makes your accounts safer, or just a nuisance? Let us know in the comments below.

I wonder how this will impact on First Directs (HSBC subsiduary)Internet banking plus? Could be very inconvienient

Natwest have offered a similar service for quite a while now, but for payments not actually at the login page. As a HSBC customer it’ll probably be a annoyance, but the reasoning is obvious. A mobile app or key fob with an ever changing code like some VPN systems use would be better!

My Daughter has a very similar device with Barclays Bank, she seems to think it’s much safer than the previous system.

If banks are doing all they can to safeguard peoples money then surely we shouldn’t be condemning the banks from introducing an added safety sytem device to individuals bank account, if this seems like an inconvenience to the personal banker just think how much of a colossal inconvenience it must be to someone trying to steal your money!

I see nothing wrong with the *idea*, but one of these days it might just possibly dawn on the banks that we are not all nimble fingered midgets who demand to be able to do everything on the move, so want some fiddly minaturised gadget that is easy to carry around.

The HSBC Secure Key is just like the card-readers used by other banks – far too small to be practical for people whose fingers aren’t as steady as they were thirty years ago, and not one of them has had the decency to offer customers a “desktop” version with normal sized buttons that we can simply plonk by the side of the computer at home, the only place we do our online banking. The so-called “Accessibility” reader offered by NatWest and Nationwide (and maybe others?) is equally useless – the screen is larger, but the keypad is exactly the same size.

I was in the process of switching to HSBC precisely because of the hassle of trying to use the fiddly little Nationwide card reader. Needless to say, with “Secure Key” on the horizon I will now be taking cheque book and debit card back the local HSBC branch and telling them where to stick them, and instead am moving to the Coventry Building Society – they don’t do faster payments, and you don’t get a cheque book, but I can live without those, and their “Grid Card” system does not involve struggling to hit the right button on some ridiculously small gadget.

My bank generates a code which is sent to my mobile via SMS this is a much better idea then having to carry around yet another device to get to my money.

I’m really not happy with them making it compulsory, if people want the extra layer of security then fine, but I don’t. I’ve been with HSBC for over 10 years and between me and my husband we have 6 accounts with them – now I’d rather go through the hassle of changing bank accounts to one without one of these stupid readers than stay with HSBC.

This is outrageous. I use internet banking regularly and I don’t have a land line, chances are this pointless gimick will not work with a broadband internet dongle.

I’ve been a HSBC customer since I was 12(!), and I’m quite annoyed at this. For me, one of the great things about HSBC has always been the ability to manage my accounts, bills etc from any computer, just using the information I (and only I) have in my head. This “extra layer of security” will be a nuisance from day one…

I’m extremely unhappy with this and felt more than protected with the old system.

To make things worse, my device has broken within a week and now will take 5 working days to replace and before I can log on again. Additionally, I have to take the old one back to a branch. Great.

Seriously considering leaving Hsbc due to this and I hope other customers do too. This would be much better if it was optional for those who wanted the extra security

If I’m honest, I quite like the idea. Others obviously disagree, but I find it very difficult to remember the ridiculously long number I need to log in, and have been told I can’t write down (although I ignored this advice). I will be getting my secure key in a month or so (why so long?) and plan to carry it with me in my wallet. I struggle to see huge security benefits – after all, if I can’t remember my login number how would anyone manage to guess it and my date of birth, but I feel it will make login easier, contrary to what others have written.

Have any of you thought about what can happen while your are traveling abroad? I’m currently in the Caribbean on a contract job for 6 months. There is no one at home in London to retrieve this unnecessary secure key. I now have spend hours on the phone to get this secure key. The mail here can take 3 – 6 weeks to come, if it ever does. I have no idea if HSBC will send my key via Fed- Ex. What happens if I loose my wallet or my secure key stop working?

Without your secure key how do you access your cash, transfer cash for any number of transactions (i.e. wire transfers to contractors, pay bills etc.)? This a royal nuisance. Please send complaints to HSBC so some of us can opt out.

This will be an intrusive nuisance with something else to carry around. How do we register a complaint with HSBC about this? I don’t understand why they can’t use an electronic solution such as Verisign VIP or something similar to that mentioned by someone else here where the code is sent to a registered mobile number or email address? I left two other banks because their device plus card requirements were so inconvenient. The only somewhat redeeming factor is that HSBC seem to have made an effort to keep the device small. I may be closing the HSBC accounts as well though; it will probably come down to how it works with an aggregator that I use. At the least, they should allow us to login and do some things without the securekey (e.g., move cash around among HSBC accounts); requiring it to just check balances and make sure upcoming direct debits are funded is a big hit to the convenience of online banking.

What is the point of HSBC (finally) implementing a decent mobile phone friendly version of their Internet banking website, only to have all of that convenience removed by the need to carry this device.

I’ve already moved my Natwest and Barclays accounts to avoid this nonsense.

It’s not like there has ever been any insecurity for me with the existing system – I’ve learnt all of my log in details.. which surely is about as secure as it gets..?

HSBC touts it this as the ‘first UK bank to introduce this level of security’, which is a ridiculous lie. As previous posters have stated, Barclays have had this for years.

I asked HSBC if I could get a second one (one at home and one at work) but was told no.

As such, it will be a very annoying nuisance. Santander offers an SMS code, which is far better. Too bad Santander is simply a terrible bank in all other respects.

I closed my barclays account when they introduced the stupid pin sentry system and forced me to carry round a calculator all day, just so I could enjoy the ‘convenience’ of online banking.

I was more than happy with HSBC’s system, I know all my login details off by heart, I can access my accounts from my laptop, work PC, even my ipod, any time I want. Now they introduce this rubbish and completely unnecessary piece of junk. I’m so annoyed! The convenience I always rated has been lost. I phoned HSBC to try and opt out and was told I couldn’t. I asked for an extra key thing, was told no. Apparently though it is convenient because it fits in your wallet! Great, what happens when somebody steals my wallet? I lose my internet banking for 5 days, that’s what! I even asked what extra security this thing gives me when my details are currently stored in my head. The answer I got was, ‘somebody could guess your passcodes’. Well that’s a risk I’d be prepared to take to keep the current system. Some people probably disagree and like it, thats fine but at least give us the choice! Morons

Absolutely ridiculous to need such a device to just see your balance or transactions.

I don’t mind having to use a device to add a payee or transfer money overseas (something I do once a year), but just to quickly log in and check my balance??

As stated above this is the mobile age where 99.5% of people have a mobile phone or a smart phone. Couldn’t HSBC be slightly more cutting edge and come up with a modern solution??

Also, no one has mentioned, that if you are a HSBC business customer, you already have another device which is not compatible with the secure key system.

Sheer idiocy.

Does it at least receive codes while you are abroad once you have initially registered it?

The Saudi American bank, SAMBA, has had an SMS code system for a couple of years. It’s highly efficient and works while internationally roaming also.If Middle Eastern banks can get this right, you’d think HSBC would have thought this through.

I happen to think this is a very good idea, I’m currently studying a masters in security and forensics so I know how easy it is to simply guess/crack most usernames and passwords. Adding an extra physical layer means hackers have no access to the device so can’t just go guess that information. This is something HSBC should have made years ago.

I am HSBC customer for 3 years and as someone above has written the convenience of being able to do banking at any computer without need to carry this dongle.

I have an account with a Czech bank – which sends a text on my mobile when I am sending money out (unless to previously approved accounts) – that’s a system that works for me. I don’t care if anyone can get into my account I just don’t want them to send money out.

I will give it a go but if it will be as unconvenient as I guess it will be I will leave HSBC. Any tips for UK banks that apply similar approach as described above (mobile phone on payments only)?

Cheers

This is extremely inconvenient…. New payments is one thing but for login as well? HSBC has conveniently launched their mobile banking website – shame the annoying piece of plastic i.e. the “Secure Key” is not much smaller than my mobile! We now have a mobile banking website which is unusable – who is really going to put this on a keyring? Personally I have resorted to using the telephone banking more. Well if we can’t access our accounts using free internet banking, we will have to cost them time and money in speaking to someone!

I have been a HSBC (formerly Midland) customer since 1985. I may have been lucky but this is the first time they have seriously annoyed me.

I can however see why they have done introduced these irritating devices. With the prevalence of viruses, malware and phishing sites they will be concerned that negligent Windows users will have their computers and bank accounts compromised. However the current system of entering 21 characters (IB number, date of birth and random digits from the PIN) provides some protection against key recording, due to the randomness of the PIN.

Security is always a balance between ease of use and protection, I think they are off balance with the introduction of this key. I can this causing many problems for older customers who have enough issues with on-line banking, and it will prove an irritation to the rest. Making it compulsory is not exactly user friendly.

I stopped using my Nationwide current account when they introduced something similar.

Think again HSBC!

This is a rubbish idea. What happens when you are travelling? If you have left your card behind? So inconvient I will leave HSBC after 20 years of loyal custom if they choose to make it such a hassle to check balances etc

I am a long-standing HSBC customer, and have seen the bank transformed from it’s days as Midland Bank. Midland branded themselves ‘the listening bank’, and for the most part, they did listen – especially to their customers. How things change! HSBC is such an enormous conglomerate company that the voices of most customers are treated often as merely irritating squeeks that dog the machine that is HSBC. This lattest gimmick seems to do little to protect taht ‘machine’ or its customers.

Putting to one side the obvious problems with the use of this device i.e. its size, inconvenience etc…there are some broader problems that render this device useless.

This device (as will all others of this nature) supposedly protect you by generating random log on codes. We are told that the device is ‘unique’ to each account, implying the random code generated is also unique. However, this seems to be a flawed a claim. There is no physical (i.e wired) link to the device and the computer used to log on, and no electronic link (i.e. wi-fi, bluetooth connection etc). Therefore, although the customer must register the device (wiht its serial number) as being linking to their account, no actual physical or electronic link exists between the device and account being accessed. That being so, HSBC’s database could not have anyway of knowing whether the randomly generated input code requested at log on is in fact a code generated by the actual device registered to the user account.

This raises a second issue. The only way the database could associated the device with the account is if that database contains all possible combinations of codes programmed into the device that is registered by each individual. The database would then compare the code entered by the account holder with the database record of possible, so called ‘random’ numbers available. HSBC has no declard that these devices operate in that manner, but if they do (as they would have to for this device to be anything other than a useless gimmick), then in fact the customer put at greater, rather than lesser risk. The security of the customer would depend entirely upon the security of HSBC’s own database…and if someone hacked that database, they would have access to both the customers personal log on details, and all possible ‘random’ codes associated with the device issued to that customer.

This device is therefore nothing more than an illusion of security which creates an inconvenient annoyance for the customer while leaving them at far great risk than is the currently the case without this silly device.

You wish to test this theory by simply entering your own randomly generated number – not one produced by the device – to see whether HSBC’s database will deny you access if all other information is correct – I will certainly test this idea.

It really just needs to be integrated into the smartphone as an app. Very obvious surely. Probably hard to guarantee security.

stupid,stupid,stupid! I cant believe we have to cart around a flimsey plastic calculator on our keyrings!, its the most ridiculous thing i’ve ever heard of, how much profit did they make last year?…..and that is all they can come up with.

PITA!

this is not good as i am away from home for 6 months and need internet banking! i cannot recieve the calculator thing because i’m travelling and i don’t want to put all my money into my main account incase my card gets stolen and used

Here is my guess at how the new HSBC SecureKey device works…

Each device has its own method for generating a long sequence of 6-digit numbers (example: divide the previous number by 13, add 5, and swap the second and fourth digits around). That method is known only to the device itself, and HSBC’s central database. That database stores, for each device serial number, (1) how that device’s sequence is generated, and (2) where the device is currently at in the sequence. When you press the green button after entering your PIN, the next 6-digit number in the sequence is generated and shown. When you type that number into the HSBC login page, HSBC updates its database to advance to the next number in the sequence, and checks that it matches the number you entered.

This process will eventually, after several years, exhaust the sequence of 6-digit numbers. Thereupon, the sequence will begin all over again.

A slight refinement is necessary. I can make my device get ‘out of sync’ with the HSBC database by repeatedly pressing the green button, but not trying to log in using the numbers it generates. To address this situation, the HSBC login page must accept not merely the very next number in the sequence, but any of the next, say, hundred numbers, and update its database accordingly.

I am horribly disappointed that these security measures are being increasingly forced upon us. Whatever the justification for increasing the customers’ burden, the fact remains that the bank is effectively reducing the service (availability of online banking) while continuing to charge the same fees for usage.

Does anyone know of a bank which has committed to not imposing such things on its customers? I for one would be prepared to move all six of our family accounts based on such a promise.

It’s a complete pain in the ass. The first time I had one of these little things it seemed really cool, but now it seems we’re being offered them from banks, Paypal and others and are going to end up having to carry around a bunch of them.

If all the banks do this I guess we’re stuck, but if it’s only HSBC I’m going to move.

Actually I think the secure key it is a good idea, I know it is another think to carry with you etc. but you have to think it’s another layer of security and maybe I’m happy with it because before HSBC introduced their secure key I’ve been using a very similar secure key for my paypal and ebay. So I think it’s good :)

I received this secure key last week and think its too big.

I have an HSBC India account as well and have a much smaller key fob the size of a small usb memory stick. This is much better to carry around and generates random numbers although and you dont have a 4 digit pin.

Why couldnt HSBC use something they use successfully in other countries?

http://www.google.co.uk/imgres?imgurl=http://www.kiruthik.com/content/binary/HSBC_IN_SEC_DEVICE.jpg&imgrefurl=http://www.kiruthik.com/default,month,2006-07.aspx&usg=__xDH8L629KSckKNO3c04ROOBTXoA=&h=175&w=298&sz=13&hl=en&start=12&zoom=1&tbnid=FWOyLZD_FIgiOM:&tbnh=115&tbnw=196&ei=LMHjTca1DYe0hAfQzZ3sBw&prev=/search%3Fq%3Dhsbc%2Bindia%2Bsecure%2Bdevice%26um%3D1%26hl%3Den%26sa%3DN%26biw%3D1024%26bih%3D653%26tbm%3Disch&um=1&itbs=1&iact=hc&vpx=349&vpy=274&dur=6189&hovh=140&hovw=238&tx=140&ty=86&page=2&ndsp=12&ved=1t:429,r:1,s:12&biw=1024&bih=653

I received my secure key just this morning – already I think it is the most annoying device that could have been invented for this purpose.

I received my secure key just this morning – already I think it is the most annoying device that could possibly have been invented for this purpose.

Just received in the post! Already looking for alternatives, if none I will definitely change of bank!

I’v been in the UK for a year, and am flabagast at the nature of a number of IT-related systems in use here. This is the worst yet. My bank (home country) generates a code which is sent to my mobile via SMS for tranactions over a specified amount – this works well. How in the world did HSBC come up with this idiotic idea/tech. How do you bank from overseas? Recommendation: change banks.

This is a dire product. What are we trying to do, fire off nuclear missiles? For goodness sake, stop this madness! In the US all my accounts are username/password. What is it with Britain? As soon as they find something convenient everyone rushes to find some way to make it inconvenient. We will be switching banks ASAP. This system is a joke.

Although, knowing Britain, every other bank will be rushing in to do something stupid like this. Anything to inconvenience the customer.

When I was sent this little piece of plastic crap I thought “hmm okay I guess HSBC know I’ve had the same security codes and what have you for 4 years and want me to simply update with new passwords, ID etc”. So i keyed everything in, and made new passwords and a security code and chucked the thing in the bin. I never heard that this is the new way to log in to my online bank EVERYTIME, I was totally oblivious of other banks doing this and had read nothing in the letters or packaging that you need to hang onto this unbelievably annoying gadget if you ever want to log in.

This is highly annoying as I’m self employed and I have to watch my banking pretty much everyday and anywhere. Where the hell am I going to stick this calculator? The phone makes so much more sense. Now I have to wait for 5 days for this piece of crap to (hopefully) arrive at my door, and I’ll be losing business in the process. Thanks HSBC.

I have just spent about 15 minutes on the telephone to HSBC internet banking because my ‘secure key’ had froze.This is one of the most stupid time wasting ideas that HSBC have had. The whole thing is extremely cheap and nasty, the keys are hard to press and the whole process takes far too long.Hopefully they will get lots of complaints about this piece of plastic and HSBC will have to think again.I have banked with Midland and HSBC since 1978 when I started working for Midland and am considering changing banks purely because of this ‘innovation’

I am perfectly happy with the way I login whether I am at home or away from it. My employer – FTSE 100 – are right now moving away from key fob style logins for remote access. So will I have to carry this device whereever I go? If this is the only way and others banks do not follow them after nearly 30 years with the bank I may have to move to one that offers security and freedom.

I am perfectly happy with the way I login whether I am at home or away from it. I had a HSBC account 2 years ago where i had to use this very annoying way to log in . This is ridicules’ as now the thief has the key to my account. The thief does not know my mind so the best security is what they don’t know. I left HSBC Singapore because of this extra aggravation to carry around and i will be leaving HSBC UK if i have to use one again.

Why are all customers being Forced to do this because a handful of non-it literate customers are having their accounts hacked into because they do not know how to secure their PCs against Virus/torjan programs. I have been with HSBC since I was a student in 1989 and will now look to move my account. A complete waste of time. There are many ways to secure accounts against fraudsters. At login in time (after user has got past initial security) they could generate a one-time use pin that could be emailed to the customers email address or SMS-ed to their mobile. This pin would then also have to be entered. I can see this fob being a serious issue for older customers. My dad has a large button BT phone that also has a large screen. Will they produce a ipad size version of this device for him ?

I, too, am livid with this new development.

I don’t carry a wallet and will need to cart this around with me if I want access to my money online. I often use internet banking at home, at work, parents or friends’ houses, internet cafes etc – this will now make it so inconvenient that I fully intend to leave to somewhere that won’t bring this system in – any thoughts out there? I cant believe you lose your internet banking service if you opt out of the fob! It’s a disgrace – Ill happily accept the risk of any monies leaving my account.

This reminds me of the time two years ago when HSBC called me 12 hours before I left for my holiday and said they’d noticed fraudulent activity on my account (ie. Myself doing lots of last minute shopping) and they’d cancelled my card. I explained it was me shopping, providing shops and amounts spent, and that I was going away that day and they begrudgingly said they’d reinstate it but I had to call them every time I wanted to use it and from that point I had ten minutes to get to a cash point to withdraw money before they froze it again. FFS!

The SMS idea sounds so much more convenient.

And while I’m at it, although this is just a feeling without any evidence whatsoever, what’s the bet that these security fobs track where you are?

I’m not convinced by the ideas put forward as to how this thing works. My guess, based upon the way similar systems work, is that it is a number generator, based on some seed. The seed would include the serial number, the date/time and maybe some other info.

Therefore the server and the dongle can produce the same number with zero contact between them, provided they’re both given the same hashing algorithm. I’ve noticed that my secure key will produce the same number a few times before changing it, which may be due to a minute having passed (although I’ve not check this). I seem to remember those RSA keys work similarly.

Of course, this is all guess work.

By the way, I agree that the thing is a complete pain. Plus, now if I get my laptop bag knicked with the key in it, there’s no more security than before.

Does anyone know of a list of banks and what login and payment security they use? I bank with both lloyds and HSBC, and lloyds has an automated phone check when new payees are added. This is great as that’s where it matters. A lot of the other so called “security measures” used by banks are done because the bosses at these banks want to be seen to be “following best practice”, like lemmings. IT security people design these without understanding human nature, so what looks good in academia and on a powerpoint does not work so well in practice because the human factor is always ignored during design.

By the way I thought Angry Little Lady’s post was hilarious, and a good example of the human factor!

This is rubbish and I will now be changing banks. Anyone know which banks offer a better method? IE SMS

HSBC had a smaller device that generated a code. I always thought this was adequate. This new calculator is FUCKING HUGE and not appropriate for a keychain. Honest to God – I’m all for dynamically generated tokens but it didn’t need to be this big. Credit card sized? Bullshit. It’s about 4 credit cards in thickness – so it’s not going in a wallet.

I am so pleased to find so many other people hating this useless piece of plastic!

As many of you have said, card readers or text messaging are a tolerable extra level of security for adding new payees but it is pretty ridiculous to ask for such measures for every time you log in.

I have about 10 accounts between business, current and savings with several different banks and being able to move money around at any time is very important to me.

Someone from HSBC rang me to try and poach my business banking and she got the full brunt of my dissatisfaction about this system and i have also complained through the my messages system (though i’ll have to log on to get the response).

For those looking for new banking Intelligent finance don’t use this system and text for new payees and i’ve found them great over the last ten years.

Can’t we just have a text service instead? These little gadgets are bound to get lost – one of my sons lost his even before he could get round to activating it, and the younger son has just spent a very frustrating half hour trying to log in, being made to change his security questions and then getting logged out again. It makes logging in at Barclays look downright relaxing in comparison. I’m going to have to keep all of the devices together on a keyring somewhere… and then someone will take them to log on and won’t bring them back and we’ll all be screwed. Dreadful idea.

@Frazer – the HSBC key tag for business banking is *much* smaller – and you just press a button for the rotating code – no need to enter a PIN.

I dont see why everyone is complaining about this device.

It may be a slight inconvenience to carry it around but seriously its really small and can fit in a wallet, also the security benfits make it worthwhile. If a malicious user has access to your computer and you login a few times over a period of time, they could easily get all your login details, including your full PIN. With this device it removes that possiblity. These devices cannot be keylogged, so the malicious user must know or guess the PIN, also the device must be in the hands of the malicious user itself to enter the PIN and generate a random key. The PIN is entered and wirelressly, but securely, verified with HSBC’s servers. The device then generates a totally random key, following no pattern or sequence, and sends this to the HSBC database to go in your password field. Upon login the HSBC servers notifies your device and it powers off, also deleting your password from their database, so effectively you have no password unless you have just generated one. This also ensures that the device must be used. It would be very difficult to have some users using the device and some not due to its complexity. Therefore everyone benefits from the added security. Also, an aggregator is an entity that logs into your account that is not you, correct? This is exactly what HSBC are trying to protect, you are making your account more vulnerable by providing copies of you banking details.

This will be a huge and pointless inconvenience and I will vote with my feet. Bye bye HSBC.

I also am seriously considering leaving HSBC for this reason. There is no way in this world I want to carry around another piece of kit. I find having my wallet, keys and phone on me hassle enough!

If I damage or lose it how am I supposed to log on to my account? Will I be charged for replacement of something I don’t even want??

I am a regular user of the internet banking service and have been with HSBC for 10 years.

Unless something is done to revert back to the old, easy to access method then I will switch banks.

HSBC you are going to lose a lot of money by doing this. I say cut your losses on the money you’ve spent on these things and go back to the old way.

You people are funny.

Hackers love your lack of care for online security as well as your identity, personal data and most of all your money.

Carrying around a calculator is nothing in exchange of peace of mind is nothing.

However, the HSBC “Secure” Key has two major security flaws:

– The prompt is the same for everybody. At UBS, you are required to enter on the calculator (after you enter your PIN), a number that is generated by the website and that is unique. not only to each user, but to each session of the browser.

– Nothing tells that the number generated is uniquely generated for YOUR bank account. There is no PIN card inserted into the calculator to identify you as is the case at UBS.

To sum up, if I were a hacker with a HSBC bank account, I too would have a Secure Key. Now, I could spy what you type on your computer, and enter the same answer to your security question as well as the code (by the way, I wouldn’t even need to have a secure key for that, just spying what you type is enough).

At UBS, this is impossible. Each prompt is different for each user/session. The code that is generated depends on your identity/account number/prompt number entered and is UNIQUE.

HSBC; go back to work !

As a traveler and only able to use internet cafes for bank transactions, the added security measure gives peace of mind because even if the hackers or onlookers get you login and password, they won’t be able to access your account.

Bank Inter is Spain gave you a small card where, after loging in, the bank gave 2 digits that produced 2 more digits from the card that you replied with. Again without this card no one could access your account. Great schemes, think the latter is more economical.

I just received mine and I want to throw it in the bin and close my account! I travel a lot and the fact I need to carry this stupid thing around me is making me so angry! The fact it has the potential to be attached to our keyrings is ridiculous!! Who would attach something to big to their car/house keys!! Grrrr HSBC should have at least made it optional. For those few who would like “added security” they could have offered this and for those of us who are happy as it stand they should have just left it as it was! I emailed them to complain and hope they get lots and lots of complaints! I also emailed first direct and asked them not to follow in HSBC’s footsteps otherwise I’d have to close that account as well!!

Outrageous. This provides a massive increase in user inconvenience. I want online access to my accounts with only the secret information in my head. If I’d wanted to use physical objects to achieve my backing aims I wouldn’t have got rid of my chequebook. I closed my Barclays account when they brought these in a few years back; now I will be closing my HSBC account. My understanding is that NatWest doesn’t use these devices – is this correct?

Been with HSBC for 15 years. The dog has eaten the first key! In the process of switching to Santander as I can’t use an account which requires me to carry this stupid device around. £55 topcashback and £100 from Santander for switching – no brainer and Santander text you a code to your mobile for setting up new payments.

to log in to hsbc online banking, i need my:

ib number,

dob,

and 3 numbers out of my 6 digit pin number.

HSBC and other banks also force you download Rapport, which is a piece of shit software i don’t need and takes up more memory than my anti-virus software.

Now they are forcing me to use this.

WTF HSBC. Give then customers what they want, but don’t FORCE THEM TO GET IT! FUCK YOU!

I for one, will be leaving HSBC if they continue with this. I am just about to to call and complain. This is a joke, I am not carrying this lump of plastic around with me.

What’s wrong with a text message or a mobile app? And why not just for new payee’s only.

Stupid.

I just called and complained.

They (very friendly) lady on the end of the call said it’s new, understands my complaints (below) and said that they are keen on taking on feedback – so please, everyone complain. I said the letter says 30days to active the key, I said 30 days to remove it or I’ll be changing banks.

My complains were:

– I can’t carry it around, it won’t fit in my wallet (or it’ll get crushed on it), it has a ridiculous key ring loop – it’ll get smashed to bits on my keys. So if I can’t carry it around, how can I use the convenient internet banking at work and at home, and on the move.

– I can understand using it to setup a new payee, but for login, it’s stupid.

– What I if lose it when abroad, and I need to make an urgent payment

– Why did you to a text code / mobile app instead

– Why can’t I opt out and take that risk on my own head

Hopefully, they will listen.

HSBC are getting worse and worse – I am angry that they are inflicting this on us without the opportunity to opt out. I have all the same concerns as everyone else.

Been a loyal HSBC customer for over 20 years – but enough is enough. Time to change bank.

Oh dear god no. I spent weeks with Barclays arguing to let them let me opt out of stupid pin-sentry. I hate HSBC’s service in all other regards apart from the excellent internet banking service. It was the only reason I stayed with them, and now this. To not make this an option is absurd. I truly hope someone from HSBC will read this and take note. I will not be researching which banks offer good IB without such devices.

Well I have this secure ID thing and after getting to step 3 (choose a memorable question), the website crashes. Now because I have only got through part of the process, everytime I go back to the website and log on, it wants me to complete the process, which I can’t. My account is now unavailable to me via the internet.

I’ve tried phoning their customer support line but the person I spoke to was so condescending (and with an almost unintelligible accent) that I didn’t get anywhere.

Just another reason for me to want to move away from the shambles that is HSBC.

I totally agree with the comments above.. I work for Hsbc and I hate the secure key.. Absolute waste if time.. I’ve already had customers in to the branch asking for replacement keys as they have already smashed or cracked theirs in their wallets.. Wrking for Hsbc does not mean I have to agree with our products.. And I too have switched my bank account ..

I was quite annoyed when I heard this would be compulsory. Like many others I like the flexibility of being able to log in from any computer at any time. Now I’m essentially anchored to my home computer as I don’t have a wallet (I keep my cards in my Oyster pass – this will hardly fit in there).

In the past I’ve needed to make urgent payments which will now need to wait until I get home, or I have to permanently carry around this stupid device. The only thing it’s a “handy size” for is me inevitably losing it. Having read some of the other comments here I’m also worried about this breaking and freezing me out of my account for up to a week as a result.

I just logged in for the first time using it. I couldn’t use my father’s middle name as a preferred security question as it was too short (perhaps he should add a few zeros to his birth certificate to make this more easier in future) and as I don’t drive or have children, was limited to the security questions I could use (how about allowing us to set our own questions?). When I went through the whole process and tried to log in (which now takes twice as long as a result), guess what?

It didn’t work.

This essentially is the end of flexible internet banking. I for one resent this; I’ve always been careful with my data and there is no way on Earth anyone would know my absurdly convoluted passwords and security questions. I don’t see how this makes my account anymore secure and it is certainly a lot less convenient.

Either replace it with an SMS service or make it voluntary, or you’ll find a lot of customers voting with their feet.

I too echo all the above complaints. Am currently in the process of switching to Santander and getting paid £100 for it!

Goodbye HSBC, it was nice knowing you!

Internet Banking is all about convenience and accessibility. This COMPULSORY feature reduces both of those.

I am afraid that they have severely disappointed me.

2nd to last thing that I need is increased inconvenience when logging onto my banking.

The last thing I need is something else on keys (especially that unwieldy)

Thanks for consulting the customer HSBC.

Livid.

We had to put up with this nonsense on our NatWest business account for a couple of year – and now HSBC want to make my personal banking a nightmare too.

Can anyone recommend banks we can switch to that won’t be implementing this technology?

(27 years customer of HSBC… first time I’ve wanted to switch)

For complaints (apparently):

servicequality@hsbc.com

My (now daily) complaint has been sent via the “my messages” system.

I actually genuinely forgot my key today, so couldn’t check my balance, nor make a payment, at work today. Terrible idea!

It’s somewhat ironic that the only bank that seems not to provide the facility of changing internet passwords / user ids now demands that we change it on every use. (Can anyone tell me how to do it on the present system?)

Clearly the issue is to do with theft – the only “risky” transactions are those of adding new payees to the profile or making “one time” payments. Lloyds TSB provide the required additional layer of security for these transactions by allowing the pre-registration of both a mobile and land line telephone number.

So when a risky transaction is being performed, an automated call is made from Lloyds to the client selected telephone number. The client must then relay the the 4 digit one time password that has been displayed on the screen by either saying it or indexing it on telephone keypad.

This additional security layer adds about 20 seconds to a process that is performed about 3 times a year by the typical retail client.

It’s a no-brainer frankly. As a client of HSBC (and H&SBC before that) for close to 50 years it’s got me into the divorce mood too.

Now

Just received this device today, not impressed. Thirty days of straightforward banking left.

I have just had a look at First Direct ( part of HSBC), they don’t seem to use these things. Hmm maybe a change is due, after 35 years!

This is a PAIN. and will reduce use of internet banking.

Has anyone got a protest group going? I have written to HSBC to complain..but would like to join forces with others .

It’s a step backward

I had already been looking for somewhere less ridiculously security-minded to bank after my Visa card was stopped because some cards with ‘similar last numbers’ to mine had been cloned-which meant being unable to access my account for five days until I received a new card.

Now this blessed security key is being forced on us. So – not only do I have my usual PIN to remember (easy enough), but in order to log in to my account I have to remember yet another PIN, find this silly little ‘key’ and fiddle about with it (with arthritic fingers) then tell them my grandfather’s middle name! These people should work for the Secret Service!

I thought online banking was supposed to be more convenient. As others have said above – time to look for an alternative to HSBC.

Can’t believe this nonsense is being foisted on us – very, very unimpressed.

I strongly object to the introduction of the ‘securekey’ without my consent. This is an example of ‘pretend security’ which will limit my access to my account without resulting in any increase in security at all. The advantage of a PIN over a key is that you can’t lose it, drop it in the water or have it stolen.

This is a system which could only have been invented by someone who always sits at the same desk; I work on building sites, sail, canoe, travel in the mountains and use the internet from my phone. My wallet is already stuffed with bits of plastic; I have a bulging keyring and have difficulty keeping my car keys dry, let alone looking after this flimsy and pointless gadget as well.

As far as I understand it this device will simply introduce a new security risk, a new thing which can be stolen because it is a physical object, not a memory in my head like the existing security.

I don’t want one and I will be moving to another, more secure bank.

This cheap thing they say is as big as a credit card. Well its actually smaller but 10X thicker. Its not really easy to put in your wallet. I also bank with Halifax and Virgin money and their system is a lott better and offers the same security with double passwor for halifax and a second login sort of password using a picture key with vorgin.

The people at hsbc wwho thought of this current system should be sacked.

This secure key is a nuisance and a burden to carry with you everywhere you go. They should revert back to the old system and implement other alternatives like that of halifax and virgin. Or there should be a choice of opting out. I will leave hsbc in a few montbs time if they dont do something about it.

Forgot to mention, just like other previous posts, I have already written to hsbc about this issue but got no reply. If anyone knows of a group or website making a protest against the securekey, please let us know. My friends and I want to jpin forces. Ta

What a horrible piece of nonsense the worlds local bank has dished up!

It is way too big, way too cheap and will end up being left exactly where you are going to need it – next to the PC – which will rather defeat the objective of the whole exercise!!!

I am strongly considering changing banks after this waste of money …. fond one that has embraced RSA type tags or something more sensible.

What a bunch of w4n&3r$!!!!

Mine came through the post today, called HSBC to see if I could opt out, I could but I would loose access to online banking. Having to carry this around is too much of a hassle for me so I took a hammer to it (after 5 bashes it still worked) and finally mangled it with a pair of heavy duty wire cutters. I’ll wait until HSBC force people to use it and then move accounts else where. BTW HSBC expect it back in the post in the next few days, oh and it would have been ok to use it just to set new payees up and perhaps transfer money over say 100 put for everyday overkill!!

I have received my through today. The benefit of HSBC Internet Banking for me is that I have all my current and savings accounts, my wife’s accounts, our joint accounts, our mortgage, and also my business accounts all available in the same place. I like to be able to log-on to my account when I am away or abroad. I also like to carry a light wallet with just a few cards and this awful device simply does not fit in.

I have sent HSBC a message through their online portal, and have signed the online petition, but frankly will be surprised if anything much happens – they don’t seem all that interested in providing what customers want after all.

After 18 years with the same bank, I will be looking elsewhere now.

Well, it’s all been said.

The way this junk works:

1. HSBC have the Serial Number of your “Secure Key” on their database, matched against your IB login ID.

2. The Serial Number of the “Secure Key” is a variable/parameter in an algorithm which generates six digit codes that follow a strict sequence, which the website knows, because it knows the Serial Number and the algorithm.

3. The website reads the code you type in, and crosses it off the list, expecting the next one in the list to be typed in, by you, the next time you log in.

SO – someone will soon crack the algorithm (if they haven’t already). Then all a thief needs is your password and the serial number on the back of your “Secure Key”. Or if they have managed to break into HSBC’s databases, they won’t even need to see your “Secure Key”!

Without your password, a thief can do nothing – with or without this 1960s style gimmick – so WHAT IS THE POINT?

COMPLAIN TO SERVICEQUALITY@HSBC.COM

PISSED OFF, ‘CAUSE ONE OF THE REASONS I LEFT NATWEST WAS BECAUSE OF SIMILAR NONSENSE.

Got the secure key, followed the instructions to set up and got it working.

Next thing I put it in my wallet, as “It’s about the same size as a credit card so it should easily fit in a wallet or purse. You can take it with you and log on to your bank account anywhere you like”.

Next time I wanted to use it, the cheap bloody thing was completely useless, because the LCD screen had spilt all over (same thing that used to happen with the old Game & Watch machines when the screen was pressed too hard).

I called HSBC to report it, and now I have to wait 5 working days before I receive a new casio thingy & can access my account online again.

Of course opting out was not an option.

Frankly speaking, this is a stupid idea. Whoever came up with it should be fired.

(End of rant. Feeling better now)

great idea in 1990.

sms via mobile is cheaper and simpler and would deal with the level of security.

5 hsbc accounts all n line… 4 kids… all on line,

where can i move to without a secure card

started a we hate hsbc secure key facebook page. need a new bank

Received this today and immediately obvious it’s going to be a complete hassle. I intend to switch all the accounts I need to access regularly immediately to a rival bank with a better system. Very poorly thought through and badly implemented process/technology.

Well theyve just lost my whole family as customers. Great job HSBC.

Now I have to get down to the business of moving all the family accounts. Should take all of 5 minutes to arrange!

I have decided to send HSBC a friendly email every time I am inconvenienced by the Secure Key. Perhaps all HSBC customers should do the same…

Google “hsbc internet banking feedback” and use the following:

Hi HSBC. Today I was inconvenienced by the Secure Key because . Please find an alternative solution. Thank you for your cooperation.

Copy this status to your facebook page and spread the word

Every hsbc customer should complain about this forced introduction to waste our time. Im not going to carry this calculator crap in my wallet, it will make it twice as big and when i sit down I will crack it then be out for weeks trying to get a new one. I can’t believe you can’t opt out. I hate banks, they rip you off then force you to do things you did not sign up for. Just look after my money without making me do these stupid tasks every time I log on.

Not happy about it at all. I’ve called to say so too. After dealing with the HSBC for 13 years and no complaints, I will be looking to switch accounts as soon as my concerns of the hassle factor this will be are demonstrated.

Ive just registered my secure key and yes I know its going to take a min or so extra to log into my account but I think its a good thing. Look at how playstation was hacked and no one saw that one coming. Criminals are getting more and more smart as is the technology for them to commit the crimes. i say bring it on if it stops someone getting my bank info then I say its only a good thing and thank HSBC for thinking about and trying to protect its customers.

And for all those who say they forget to take secure key to work why would you its WORK and checking your bank balance online is not really work and would think that most employers would deem this as gross miscounduct!!!

mel2011 – I get this magical thing called a lunch break. I also do this thing called getting into work early. You should try both sometime. I also use various computers on the go, and at different locations. By the way, this device is quite easily – for the smart criminal – crackable. Something like a text/email/phone app could be much more secure.

At the end of the day, if you are stupid enough to use an unsafe connection, or click an email scam, then you deserve to have your online bank hacked – if you leave your car keys out next to your car, expect your car to be taken.

James in the environment I work in even on breaks or working in own time the use of company equipment for personal use is a big nono!!! So i must work in a very strict place compared to you all. My computer always has up to date virus software but for me I like the extra security it will give me however as I said before I have only just registered it so perhaps the novelty will wear off and it may become another thing that pisses me off daily.

mel2011 – You cant assume everyone works in the same working environment as you do. This way of thinking is similar to what HSBC have done when they decided that this solution fits most people’s lifestyles. I access my IB equally from both work and home. I also access it on the go, be it from the ipad, from the laptop and from secure terminals. The chances that I will need my IB at one of these locations and not have my SK are pretty high.

I had an email conversation with HSBC when I first received the letter about the Secure Key. As an IT manager and software engineer, I felt that the solution was a backwards step for technology and that a mobile app could be developed as an alternate solution. A large percentage of people have access to a smartphone or can receive an SMS code (I dare say most people that access internet banking, also own a mobile phone). I suggested that a mobile app be developed for those that want to use it, and was told that this was more difficult to implement then the SK (I would paste the conversation but my SK is at work so I can’t log on to my IB – the irony). The excuse that an alternate solution is more difficult is not an excuse in the IT world. This sort of challenge is what people such as myself go to work for. This sort of alternative might take a while to design, develop, test and release but HSBC should really give people the ability to opt out of this one-size-fits-few solution until something better is released.

mel2011 –

First off – hope you’re not browsing this from work, you might get your P45 tomorrow.

1. It’s not about the extra time taken to log in – the problem is that you are dependant on a PHYSICAL OBJECT to access your internet banking. As long as my head is attached to my body, my password goes with me wherever I am.

2. Playstation was hacked remotely – see my previous post (Yorkshire Joe) – a system similar to this “Secure Key” would not have prevented it.

3. You are worried about people getting your “bank info” – shouldn’t you be worried about people getting your MONEY?

4. Stop deviating from the point talking about “company equipment”, “personal use” and “big nonos”.

5. “Virus software” is just another age-old scam.

6. In your last post you refer to the Secure Key as a “novelty”. I couldn’t have put it better myself.

Bye for now.

Hamiora – Speaking as a software developer, I couldn’t agree more. What can we do to convince HSBC it’s rubbish? HACK IT? LOL

@hamiora yes I’d be well up for a mobile version I too use access the bank on my iPhone but it will all come down to the cost expenses of the bank to set this up. I see all of your points and yes the comments on here see some people are for and against it I read on hsbc website that if you want to opt out then you’ll no longer be able to access IB any longer!!! Seems a bit excessive to me!!! Surely all banks will soon follow (those that already dont have something similar) maybe as you’ve all said your complaining hsbc may reconsider the option to opt out hopefully they will be able to come up with a solution so everyone with different lifestyles is happy. it’s incredibly easy for me to use as I only log on at home as I said before so other than a few mins extra it’s not really a big deal to me but I can understand how this to you all is a big thing @Yorkshire Joe lol good job I’m not at work

I like no nonsense banking and this bloody thing I’ve been send looking like a cheap piece of plastic that’s sure to break within a week is far from my ideal banking solution and where’s my freedom of choice it’s not the point that HSBC has brought this out it’s being told you have to use it and that’s it I dont take to kindly being told what to do.

I received this and have today tried to activate it only for it to crash every time I try so now i can’t access my bank account at all which means I can’t process my payments and transfer my money just great as it’s payday tomorrow and my payments need sorting out!! What a stupid idea, the woman when I rang tried to talk me through deleting my internet history and resetting my router to get it to work!

How STUPID!!

I’m seriously contemplating moving bank after 15 years service. Absolutely ridiculous!!!

The screen on my secure key has already broken after 5 days. Kept it in my wallet but the key is stiff unlike a credit card which flexes a bit. Suspect most men will break it very quickly when they put their wallet in a pocket. No access now for 5 days. Hhopeless

My other bank has sent its clients a card reader. You can just slide your credit or debit card into the reader which in turn plugs into a PC via a USB connection. You then fire up the bank provided application that requests you to enter your debit or credit card PIN. I guess that the application communicates with the chip on the debit card and perhaps has an encrypted chat via the internet with the bank’s authorisation system… but in the end you get logged onto you bank’s internet system. It’s a little bulky but you can get a second one or use somebody elses… It is your card that is unique not the reader. I’m still looking for that bank though.

Ken Self – are you suggesting that carrying around a bulky card reader which needs to be plugged in to the computer is an viable/acceptable alternative?! Come on, man!

Best thing anyone can do is change their password regularly and make sure they remember it. Not difficult.

I wish HSBC would make this “inSecure Key” optional. I Really Do…

No Joe, I’m not suggesting that. I’m suggesting that there should be such a thing as a generic smart card reader that allows us to use our many chip embedded cards to securely identify ourselves on a variety of web based applications. It certainly need not be carried around as there would be nothing unique about it.

It’s not easy for the average user to change many passwords regularly and commit them to memory bearing in mind the dangers of using the same password across the spectrum of applications. Not that that’s possible anyway as some applications have password rules that exclude others.

The truth is that there is a serious threat out there but I agree that HSBC hasn’t come out with a great solution. And, had they limited is use to the two functions (adding payees to our beneficiary profile and making one time payments) then it would probably have been acceptable to most of its clients

Appalling thing. Internet banking is now over thanks to hsbc scum. Fucking idiots. I will close my account tomorrow and move to an altogether less wanky bank.

Ken Self –

I’ll tell you my approach to passwords:

I remember an unchanging ‘masterkey’ and make it a constant in a formula (the formula I can write down, and place ‘X’ where the key goes).

eg let’s say

my IB password is 12345678

my key/X is 98765432 (this key exists ONLY in my head)

SO, the formula I write down is

HSBC IB password = X – 86419754 = 12345678

Most important passwords I change every so often, and I use these regularly enough to get used to them after 2 days of reminding myself with a scrap of paper which is useless to anyone except myself.

A simple, easy and cheap solution to security issues which I would recommend to everyone, including the security “professionals” at HSBC.

By the way, that’s a simple example! I use a modified version for passwords which require UPPER and lower cases.

The number of people on here complaining about extra security being added to their accounts is astounding, you pack of blithering idiots. Are you all really so molly coddled and lazy that carrying a tiny device and spending an extra few seconds logging in is such a terrible inconvenience it’s worth switching banks over. This has been done for your benefit and to save everyone involved money and hassle.

As someone who deals with web security professionally I firmly believe people like the ones complaining here should be banned from the internet, they make it less secure for everyone else and I hope scammers and phishers empty every last penny from their accounts.

Cynic – as a systems engineer/web developer, I know that there is NOTHING more secure than changing your password regularly. Systems should help people to do this, and it’s up to people in the know to educate people why it’s important.

Do you REALLY believe that the “Secure Key” makes things more secure? Please see all my previous comments!

Once again – the extra TIME taken to log in is NOT the problem for me – it’s the fact that we need to rely on a PHYSICAL OBJECT to access our IB.

WHY CAN’T THEY MAKE IT OPTIONAL? I’d be perfectly happy to sign a disclaimer.

Cynic – if you really believed that expressing valid points means you qualify for being banned from the internet, then I suggest you go and live in North Korea.

I just got a very nice response back from HSBC customer service. Sadly, they won’t be changing, but I think if enough people carry on mentioning how bad this key is to servicequality@hsbc.com then they might take some improvements on board.

this is such a stupid idea. i think that there was enough security before they invented this horrible peice of plastic. Mine has stopped working so now i have to wait 5 days before i can get another one. That means no internet banking for 5 days and it’s how i make payments all the time. It’s caused way more hassle than what it is worth and i think you should have the choice whether you have the extra security or not. Proberly going to change banks just so i don’t have to deal with the hassle of a cheap and tacky peice of plastic that doesn’t work.

At least it proves that what they say about bankers is true and they have fat wallets…well they certainly do if they carry around this secure key device!. A real step backwards for consumer convenience and a lot of other banks have better ideas for security improvement. I believe HSBC have got this wrong and it’s REALLY annoying!.

Cynic, it’s not carrying around one tiny device I object to, it’s that I have to carry around several single use devices (HSBC, my work’s VPN, client VPNs, …) when all of them could be either apps on my phone or sms based services. I haven’t carried a separate calculator since the 1990s. Nor a separate organiser/diary. I don’t even wear a watch anymore.

I’ll gladly use any device(s) that they issue, if they weren’t making them so monumentally inconvenient. If, like the other banks, they were using a card reader for this purpose, that you put your debit card in, I could have one at home, one at work, one at my parents etc. But HSBC are determined to issue only one device per account, so into my pockets it goes, or I lose internet banking.

I am actually a Barclays customer and dont have any particular issue with their similar Pin Sentry system but was appalled when my mother tried to log on with the HSBC device when it arrived in the last few days. She is 86 and severely arthritic but always been computer savvy and a big user of internet banking. This tiny, fiddly device is however virtually unusable for her but it seems she has no alternative other than to either switch banks or revert to using cheques and requesting statements etc. I suspect many other elderly users will have the same issue. Very poor.

@Cynic – it seems you continue to be rather outnumbered in this forum! A lot of people here are voicing VALID (and NON-cynical!) concerns about the Secure Key.

Bye for now.

I am a Canadian who has an HSBC account in the UK, have done for many years now. The only problem I have with the bank in this instance is that I am now locked out from checking the transactions made to that account. I like the idea of better security, who doesn’t these days?, but surely it would have made more sense to allow me to have access until I at least received and activated the gadget before locking me out this way.

One more thing, is the bank supplying this Secure Key free of charge, or will they charge for its use down the road? Banks are not know for giving us anything for free, let’s face it.

Apart from all the faffing about, has it not occurred to HSBC that if i’ve got my phone in one hand and my Secure Key in the other, that I am far less secure and entirely vulnerable as it’s very obvious that I am accessing my account details?!

That’s a good point Jodie. And maybe it’s all about the free advertising they’ll get while you wave the HSBC logo around

I am now on my 3rd key and I’ve only been using it just over a week. 1 cracked in my wallet (the screen), the replacement I got from branch (incidentally, just walked into the branch, no ID nor even that I was and HSBC customer was taken from me) locked out because they didn’t reset my account properly, so hopefully, today (after queuing at a branch again), will work.

I’ll echo what people said – I’m all for additional security, but I don’t believe that this device actually gives us much more – there are far more secure and far more convenient online banking systems out there, and if HSBC don’t sort this out, I will be leaving them (I’ve given the deadline of the end of the month).

Why they didn’t do an SMS/Email code is beyond me. Someone in their IT strategy department needs firing.

Unlikely that anyone’s voice here will be heard, unless you make yourself heard at the AGM. remember that even if their IT strategy is wrong, they have spent the shareholders money and now have to defend their decision at all levels. If the majority of HSBC customers in the millions don’t complain then it will be considered accepted.

Lloyds has an excellent method matching security and convenience. I do not work for lloyds but also bank there

I’ve been looking at the Lloyds system and it does seem very good.

HSBC have been very good at replying via servicequality@hsbc – I’ve had one letter back so far, and a promise of a reply to my 2nd (although have just added a 3rd).

I think the issue is, they’ve invest in a device and a massive ad campaign of “isn’t our security great” and to back track on that would be really hard for them. Saying that, the internet is a very powerful tool and forum’s like this I’m sure will be read.

However, as I said, I don’t mind keeping it if they change their system to a 2 tier system….

1 which just shows my account and transactions, and possibly allows me to transfere money between accounts and existing payments (again, showing minimal details)

2 the full system that requires the key

(again I have suggested this to them)

incredibly annoyed with this new secure card rubbish, had it a little over a week and the stupid thing wont switch on, now ive got to wait 5 days for a replacement to come through the post!!!

and as for convenience…….well its completely gone! i used to log on to my account dayly – with just the memorized security info in my head – by far and away the safest place for it to be- just to check payments going in and out, make sure i wasnt overdrawn (coz we all know they charge us for the priveledge)and watch my savings grow bit by bit!

tonight for instance, was going to move a bit of money to my current account and have a dably on the euro millions……but what do ya know CANT LOG IN!!!!! ooooh the irony of winning £135 million and then opening a new account with another bank to deposit my winnings!!!

It’s ridiculous that they should force this on customers with no opt out. I’ve complained to the HSBC about this already.

I’d misplaced the stupid secure key and, after a couple of hours of ripping the house up, found it again. Not before I’d called to tell them I’d lost it however.

HSBC said they’d send a new one but it’d take over a week to get to me. And when I called back to advise I’d found it, they said I’d have to wait for the new one to arrive as they’d cancelled the one I had in my hand.

The idiot at HSBC was very interested in force feeding me the benefits of the card and just how ‘hard-on’tastic he finds using it.

I’ve been with the HSBC for over 20 years and am now looking to move elsewhere.

It’s absurd…. can’t we get a petition going??

I’ve set up a Facebook group which, if it attracts a decent number of people, should point out the obvious to the people at the HSBC. Therefore, if you want to help, please join;

https://www.facebook.com/home.php?sk=group_202276189819529

Thanks.

I have for many years (about 40)authorised another person to access every aspect of my HSBC accounts. However HSBC will not allow that person to have their own secure key to enable them to do so. They say that there can only be one key for each account. However if it were a joint account I believe each person would be allowed to have a secure key so they do in fact allow more than one key for an account. They blame the security system for not allowing more than one key on my accounts but who controls the security system? Surely the system should not dictate the rules but HSBC should do so and change the rules to meet with customers wishes. Other banks have various security arrangements but they all seem to be able to cater for an authorised signatory being able to use the account on the internet. I hate to have to change banks after about 65 years with one bank but may be driven to it by this refusal to amend their system to cater for something they seem to have forgotten about.

Sign the petition:

http://www.petitionbuzz.com/petitions/hsbc

SIMPLY RIDICULOUS!!!! we have been blessed by the appearance of internet to have access to our banking accounts whenever we need it. Now this forces you to be at back home to access your accounts, as I don’t carry a purse where to place this idiotic gadget with me all the time.. Even worst if you lose it!.. More and more banks are giving you access through mobile phones to have banking capabilities on the move… HSBC is screaming out loud just the opposite: PLEASE DON’T DO BANKING WITH US! They should fire the people behind this move on the spot.

I’m forced to use it ever since HSBC sent this key. It’s silly there is no provision of a BASIC access to login to do simple tasks like checking balances. Barclays has this provision and the simplicity yet security inclines me to use them more often as my primary bank.

BTW, google uses a mobile phone key generator. I can only hope banks will follow the leader!

Yet another dissatisfied customer. Looking to move account after 35 years with HSBC.

Whole point of Internet Access is it’s availability. At the moment I can access our accounts within seconds at home/work/friends etc without having to carry the secure key around just in case I need it.

We have also been able to transfer funds when an emergency occurred whilst we were abroad which we will obviously not be able to do without having this key with us.

Our daughters have been backpacking at various times and this would be yet another thing they would have to worry about.

I use a similar device at work for Barclays and it is a hassle there so it is not something I want for my personal account.

There must be a better way to improve security.

This device is dreadful. It almost impossible to use without a torch and a pencil to hit the keys. I am fuming that I am FORCED to use this device. I asked for a larger one and was told that it could be replaced by a device 15cm square and that they would de activate the smaller one (after I called an 0845 number !!).. What on earth were HSBC peope thinking when they devised this little number. I can only hope that enough people complain and that it disappears. I bank online with six other institutions and NONE of them have brought in such nonsense. When I asked how the disabled and elderly were supposed to use it, I got the answer that they could get the ‘huge’ version and deactivate the other one. Do not the disabled and elderly go on holidays HSBC and may not they want to access internet banking while away??? We still have lots of marbles left you know. It’s just that sometimes the fingers are not so agile. I am FUMING.

This thing is awful. I’ve finally been forced to opt into it. Have sent complaint e-mails and signed the petition. I don’t mind the extra security questions and I wouldn’t mind the key if it was only used for actual payments or changes to my account. I will also leave for another bank if they don’t change this.

I’m sorry, this is…incredibly retarded. Someone should send them this link with all the complaints, I’m a computer science graduate and I know for a fact that there are better solutions to this problem. This is a definite step backward, they are introducing it as some sort of hi-tech futuristic solution and it’s complete bullshit, and the fact that you can’t opt out is just unjustified. Why can’t you simply let us sign a paper saying that we’re responsible for the security of our own computers? Why do you have to start ******* around with a perfectly stable system that is already working fine for 99% of your customers? The last thing I need is my bank making my financial life harder, I just want you to keep my money physically safe and let me worry about my online banking security. I don’t want your freaking calculator in my pocket.

Agreed…HSBC have missed a trick here.

Why use an additional device, and not package it as a mobile app??

Perhaps they’re making the case for a VeriChip to be implanted in your arm.

See http://www.youtube.com/watch?v=44f5A8PCWiU

IBM RFID Conditioning – Shopping in the Future as a Chipped Human

I’ve had my key for just a few weeks. I went to log in with it for the 2nd time since it arrived and the screen is smashed – little suprise with it being thin plastic and stored in my wallet that lives in my back pocket. I now need to go to my branch tomorrow to get another one…that I will put in my wallet…that will no doubt break in a few weeks!

I’m sure it was designed to go in a wallet so why is it breaking? Do I now need to change where I have ALWAYS kept my wallet and risk losing it, together with all my credit cards and cash? I could leave it at home and then not be able to access my Internet Banking whilst on the move…not ideal!

I’ll give the next one ago and if it breaks, wait for them to change the system. Like everyone above, I can take my money elsewhere if this proves to be an issue!

If there were no criminals online , internet banking would not even need user ID and password. why were they introduced? There is a reason for all this. this is good development to me. I wish it were mandatory on all internet banking in Uk.

secure key idea isn’t bad but needs further development. Banks’ should join in producing one the key for all of them. Something of “joint key”. So before entering SK pin code, you enter Bank’s number. And certainly, mobile telephone app would be ultimate convenience as you do Internet Banking on phone.

This is interesting reading! I stil haven’t received my card reader and now I can’t get on to IB at all! Tried ringing HSBC and was put through to a very unhelpful woman who told me I had to reset all my phone passwords! I dont want to use the phone, I want to access my money online!!! Not impressed! At least most of you can still get online, albeit at a convenience!

Arrrrgh i hate it,i havent a clue how to use it and now its locked

how many numbers are we supposed to keep and remember. Get rid or i will be switching to a different bank

Can someone tell me which bank has the system where the pin is SMSed please? I’m switching as soon as I find out. I may keep a HSBC account open, but most of the money and all the banking is moving!

Hi Sowmi, Lloyds allow you to pre-register both a mobile and a landline and ask you on which one you would like to receive the PIN (session password). You can then select the one most convenient to you at the time. This is only done on transactions deemed as needing the additional layer of security – such as payments.

Yep, I’m opening with Lloyds – so far a very easy application process.

As the taxpayer owns most of it anyway, I’m happy to send my money there instead. And if it means I don’t have to use a goddamn silly “Secure Key”, then I’m happy.

Thanks for listing Lloyds as a more user friendly alternative folks.

I will be writing to HSBC informing them of how this is the final straw for me.

I’m off.

Not happy at all. These devices are just an utter pain in the arse. No opt out? Thanks for the last 15 years HSBC, but I’ll be leaving you.

What an absolute joke! I can’t believe that I am going to have to carry about this ridiculous toy to access my money. There is only one branch of HSBC in the West of Scotland. If I leave it at work or forget to take it with me I am stuck. What happens when it stops working or you lose it, how long will you go without. Morons!

I have banked with The Midland /HSBC for 40 years. I have been saddened by the reduction of branches and dehumanisation of those which remain, this has been compounded with the relocation of the “call centres” to low labour cost countries, regardless of an inability to comprehend English, resolve branch related issues or provide pretty much any useful purpose other than to advise me to go into my local branch, and yet, still l remain a loyal customer. Well – no more! Having received my cheap and particularly poor quality device this week, l was amazed to find l am required to carry this piece of “tat” around permanently assuming l actually want to access mobile banking……HSBC wake up, your customers are not impressed, l for one will be leaving!

@Glenn June 14th, 2011

So how exactly does the keypad communicate with your PC then?

And it turns off by itself – after 30secs not by some mysterious communication from the mothership.

Nice fantasy you had going though.

The fact that you have to carry it around with you is a royal PITA though …