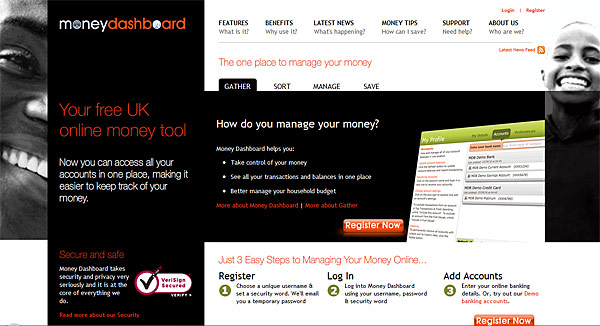

Following a beta testing period of around 9 months and involving 10,000 users, Money Dashboard has launched, which aims to “provide a simple online solution for time-poor consumers who struggle to keep track of spending and income”.

Powered by Yodlee’s account aggregation tools, Money Dashboard has been developed as a rich internet application using Microsoft’s Silverlight technology.

Whilst this does allow a richer experience to the user, behaving more like a desktop app than a regular website, in testing I have found it a little slow, although that might be more a reflection on the hardware I’ve been using to access the site, rather than Silverlight itself.

Gavin Littlejohn, founder and CEO of Money Dashboard believes that the Government’s austerity measures coupled with the ongoing impacts of the recession have forced the public to look for ways to save and manage their finances more effectively.

“The UK consumer has shrinking access to financial advice, with few people either knowing their bank manager, or having an independent advisor from the professionally qualified sector. More and more people have realised that with reduced access to credit and with the impact of government austerity measures that they really have to sit up and take control. Money Dashboard is a product that will take a lot the fear and hassle out of managing on a tighter budget. Since we are independent of banks and building societies, our priority is always the consumer and helping them to make the most of their finances.â€

As a free service, Money Dashboard plans to monetise the application by offering access to financial products via “Ways to Save†pages on which it will earn a marketing fee from the provider. This isn’t a particularly cheap business to be in, so it will need to start generating income as soon as it can to prevent it going the same way as another Yodlee-powered aggregator with similar ambitions, Kublax, which ran out of money and folded early last year.

Money Dashboard has raised £2 million of funding to date, from business angels with deep experience of the retail finance sector and from investment firm Par Equity. Further capital will be injected as part of the next phase of market development.

We’ll be taking a more hands-on look at Money Dashboard over the next few weeks, but if you’ve used it, let us know your thoughts in the comments below.

This looks really good, I’ll be looking forward to reading your thoughts on it. Keep us posted!