![]() photo credit: whiteafrican

photo credit: whiteafrican

We’ve talked a lot about mobile payments recently, and whilst the technology to achieve payments with mobile phones is developing thick and fast, there’s another factor holding back its adoption.

Quite a big factor too; the end user.

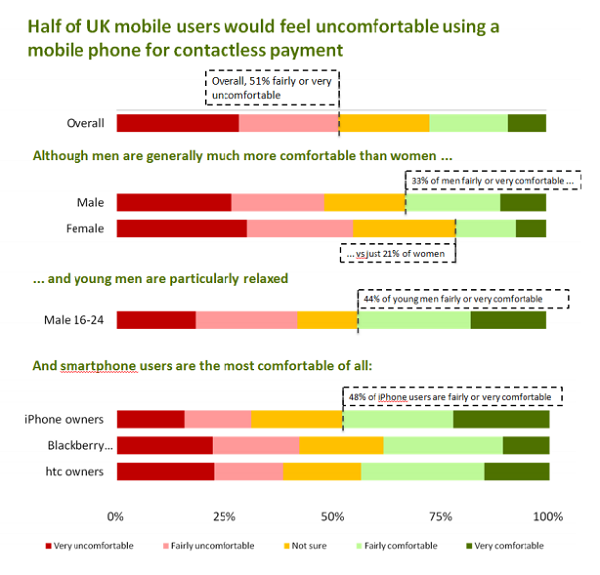

Earlier this week the results of some new research was released which concluded that more than half of Brits are uncomfortable with the idea of completing contactless payments with their mobile phones.

2,500 people were questioned in the Vision Critical survey, with 51% responding that they were “fairly or very uncomfortable” using mobile payments. There was also a clear difference between the genders; women were more sceptical than men, with just 21% of women comfortable with making contactless payments, compared with 33% of men.

The survey also looked at who users would trust with their mobile transactions, with banks coming top of the list above mobile and card companies and the handset manufacturers. Users also seemed to prefer funds being debited direct from their accounts rather than a specific mobile wallet – 41% were for the former, just 20% for the latter. This surprises me as I would have thought security-conscious users would want to isolate their mobile transactions from their main accounts.

The results also showed that cash and debit card use would suffer most from the onslaught of contactless payments, whilst credit cards wouldn’t see as much of a decline.

Finally,the research suggested that smartphone users would be the most enthusiastic about making mobile payments, iPhone users leading the way, with Blackberry and HTC users not far behind.

This will all be interesting news to companies currently trying to take the initiative with mobile payments, such as O2 and Orange, who both have plans to bring contactless payments to the masses over the next few years.

Read the full survey report (PDF).