There’s a good story on Finextra which demonstrates the danger of trying to use Twitter to measure sentiment.

The Bank of England’s social media team charged with keeping an eye out for evidence of a run on a UK bank were alerted to a suspect spike in the run up to the Scottish Independence referendum.

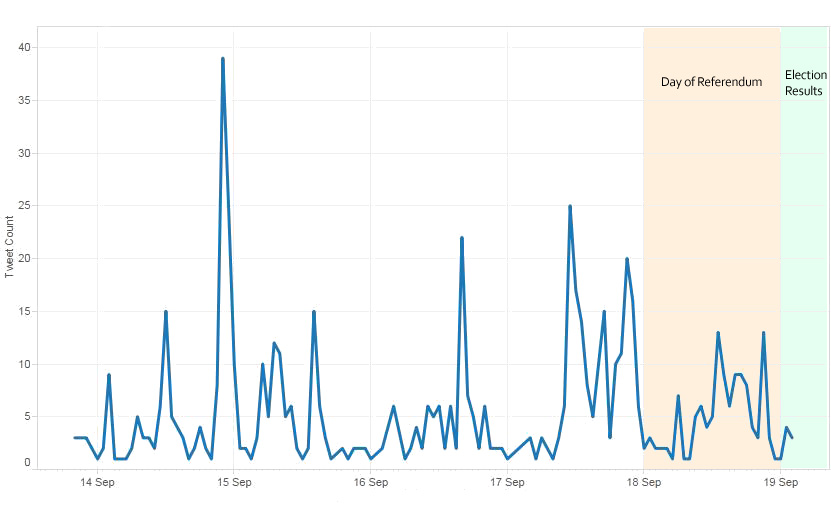

Could Twitter help predict a bank run? That was the question a group of us were tasked with answering in the run up to the Scottish independence referendum. To investigate, we built an experimental system in just a few days, to collect and analyse tweets in real time.

The terms that caused the spike? “RBS” and “run”. Used together, this could suggest that the Royal Bank of Scotland was about to see a large number of withdrawals. Given the uncertainty of the referendum outcome, and the future for the bank in the event of a “yes” vote, this may have been pretty concerning to the Bank of England.

However, there was another explanation for the spike on their graph:

…our attention was drawn to a spike in the early hours of Monday 15th September. However, we quickly realised that this was driven by American Football, rather than events closer to home!

On closer examination, it transpired that we were looking at a series of tweets and retweets involving the Minnesota Vikings. This had been captured because they combined the term “run†and the abbreviation “RBsâ€. But in this context, the reference was to Running Backs and not the Royal Bank of Scotland! To avoid this pitfall, the search terms were subtly changed to avoid that particular pattern of upper and lower case characters.

You can read more about this experiment at Bank Underground, a blog written by staff at the Bank of England.

I would have never thought a share price could be affected by twitter or a game of American football.