This is the first in a series of reviews of UK personal finance management tools. Here, we look at the “daddy” of most PFM tools, Yodlee. Despite being based in the US, it has decent coverage of UK banks and financial providers.

Yodlee is possibly best known for being the technology behind some of the biggest PFM tools, such as Mint in the US (although they’re now powered by owner Intuit’s own infrastructure), as well as lovemoney.com online banking and MoneyDashboard in the UK (both of which we’ll be looking at in this series).

The reason for this is that Yodlee’s has invested a lot of money into their technology, with security of the account information being key, and they’re willing to licence their technology to other partners, allowing other services to build upon their infrastructure.

Yodlee MoneyCenter

Yet it also has its own front-end for managing your various accounts: Yodlee MoneyCenter.

Signing up for MoneyCenter is free, but you might want to check out Yodlee’s terms and conditions before committing. Firstly, whilst the service is free, they do reserve the right to start charging in the future. And as Dan has pointed out, there are some pretty scary terms about granting Yodlee power of attorney:

For all purposes hereof, you hereby grant Yodlee a limited power of attorney, and you hereby appoint Yodlee as your true and lawful attorney-in-fact and agent, with full power of substitution and re-substitution, for you and in your name, place and stead, in any and all capacities, to access third party sites, retrieve information, and use your information, all as described above, with the full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection with such activities, as fully to all intents and purposes as you might or could do in person. YOU ACKNOWLEDGE AND AGREE THAT WHEN Yodlee IS ACCESSING AND RETRIEVING INFORMATION FROM THIRD PARTY SITES,YODLEEÂ IS ACTING AS YOUR AGENT, AND NOT THE AGENT OR ON BEHALF OF THE THIRD PARTY. You agree that Yodlee’s third party account providers shall be entitled to rely on the foregoing authorization, agency and power of attorney granted by you.

If these terms put you off using account aggregation services, then you probably need to look for another type of PFM tool, one that requires you to manually manage your data, rather than handing over your details to a third-party.

Whilst they do look scary, they’re there to allow Yodlee to go off to each of the accounts at each bank you add and download your transactions and balances.

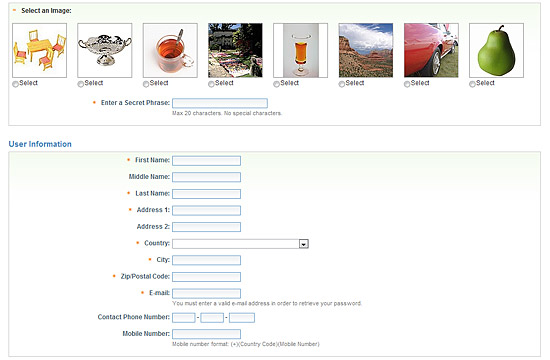

Registration

If you’re happy to proceed despite the terms and conditions, then registration is straightforward, although there are quite a few questions to answer in order to setup your Yodlee account securely.

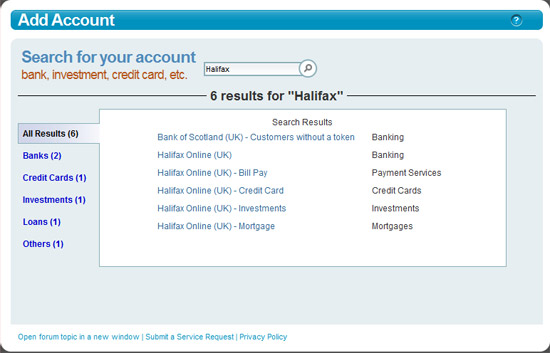

Once you’re registered, then the work adding your accounts begins. You’ll need all your bank account / credit card etc. usernames, passwords and security question answers to hand so that you can add each account to Yodlee.

Thankfully Yodlee account coverage is pretty good, covering most of the major banks, building society and credit card providers, as well as some investment providers, which should provide you with a pretty complete view of your finances. Most of the example sites shown will be US-based, but a quick search will tell you if your account is covered:

Once you’ve chosen your account and entered your security details, Yodlee will then go off and download your account balance and transactions whilst you add more accounts.

You can also add manual entries, such as the price of your home, or accounts that can’t be tracked automatically, to give you an even fuller view of your net worth, but these will need keeping up-to-date by yourself.

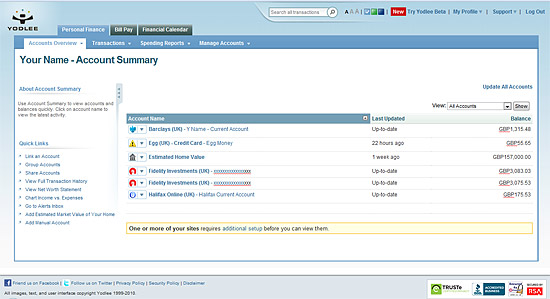

The Dashboard

Eventually, you’ll have all your accounts ready, and be presented with your “dashboard”, which should give you a good overview of your finances:

From the dashboard you can then drill down into each account to view your transactions, and this is where it can get really interesting.

Categorisation

When each transaction is imported (Yodlee downloads transactions on a regular basis, or you can manually fire off an update if you want the most up-to-date data available), Yodlee automatically categorises it so that you can then see where your money is being spent.

Naturally, it won’t always get the categorisation right (and again, the naming of categories is very US-influenced), but you can change categories and rename them to suit your own requirements. It will also remember when you’ve categorised a transaction and apply the same category the next time it appears. It’s quite a simple job to make sure all of your transactions are assigned to the right category, as over time most will be tagged automatically.

You can also split transactions – for example, we subscribe to Sky broadband, telephone and TV, but it’s only shown as one transaction on our bank account, but for correct categorisation we split it up into 3 categories: TV, telephone and broadband.

Reporting

The benefit of all of this categorisation is that you can then report on where all your money is getting spent. Yodlee has a set of reports that you can use, such as the cash flow analysis, which shows income and expenditure over time, and the expense analysis, which shows you how you’re spending your money.

The reports can be changed to show a certain timescale or to include/exclude certain accounts, so there’s a fair bit of analysis that you can do on your spending. The graphs are also interactive, so you can click on a slice of pie in the expense analysis report for example, and it will show you the transactions that make up that portion of your spending.

Conclusion

We’ve only touched the surface of all that’s available within Yodlee; for example, it’s possible to setup email or SMS alerts for when any of your accounts reaches a certain level or has a large transaction. You can also set a budget on your spending and receive alerts when you go over budget in any category.

Whilst some of the other tools that we’ll look at in this series probably present the data in a more appealling way, I think Yodlee works quite well at displaying the data in a simple and clear way. Some users might not like having to handover bank account security details, but Yodlee’s big advantage over manual import tools is that it makes everything so easy.

It also feels quite “independent” compared with other tools – by this I mean that there isn’t an obvious business model built into Yodlee MoneyCenter at the moment. Whilst other tools aim to be monetised by suggesting deals on financial products or by featuring advertising, this isn’t currently the case with Yodlee. This could of course change, but right now it allows for quite a simple, clean experience.

The terms and conditions are very clear that this is only intended for use in the USA:

“In order to register or use Yodlee MoneyCenter, you must be at least 18 years old, a United States resident and legally capable to enter into contracts.”

I agree with the previous commenter. Why is a .co.uk website recommending UK citizens use a service whose terms and conditions limit it to US citizens only?

Does anyone read these t&cs? =p

I’ve also just discovered that the Google Play store doesn’t allow you to download the yodlee Android app unless you are in the US.