According to KPMG’s fourth global Consumers and Convergence report, consumers are becoming increasingly comfortable using their mobile phones to manage financial services:

Although still in the minority, users are becoming more comfortable in using their mobile handsets to manage financial services, just as they adopted internet banking, electronic bill-payments and e-commerce at the start of the broadband era. While security and privacy dominate users concerns regarding online and mobile transactions, they are becoming more willing to set those aside to gain the benefits and convenience of conducting personal business through their mobile handsets. Still, those comfort levels are not yet universal.

More than 5,600 people in 22 countries worldwide participated in the survey, which examines trends in the use of mobile technology.

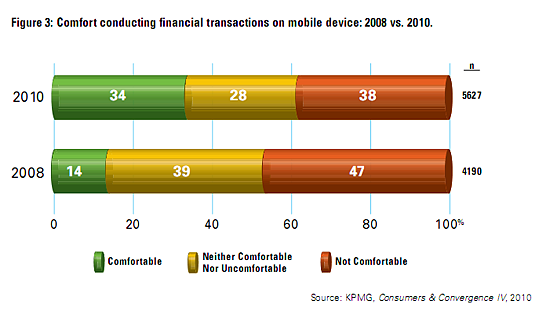

Their survey showed that more than twice as many consumers today indicated they are comfortable using a  mobile phone to handle their online financial tasks than in 2008 – 34% in 2010 compared with 14% two years ago.

But of course, that still leaves nearly two-thirds of people who aren’t comfortable, with the most common reason given for this being security.

China currently leads the way in the uptake of mobile banking with 77% of consumers using their phones to conduct financial services, compared with 19% in the U.S.. Sadly, I couldn’t spot an equivalent figure for the U.K..

Age Groups

Age is also a factor in mobile bankings use. U.S. consumers age 16 to 24 conducted mobile banking the most, with 33 percent of the respondents in this bracket indicating they have conducted banking on a mobile devices.

More than twice the number of consumers 54 and under used their mobile phone to conduct a banking transaction in 2010 than in 2008. As in previous years surveys, older consumers appear to be more reluctant to use their mobile phones for online banking, but adoption is increasing to 18 percent of those 55 and older in 2010 from 12 percent in 2008.

Survey results suggest this was not because they had more concerns over security. Potential explanations include reasons of habit, or capabilities of the devices themselves; as later adopters of mobile technologies, older consumers may not have the most feature-rich phones, nor may they feel comfortable viewing information on smaller screens. If handheld units, such as smartphones or tablets, with larger screens and more feature-rich applications become more ergonomically appealing, older consumers may adopt advanced mobile banking services for convenience.

Mobile Banking Frequency

And there are some interesting results when it comes to the frequency of mobile banking:

In addition, 10% of the U.S. consumers said they conducted an investment transaction, such as buying or selling shares, on their mobile device. Â By comparison, nearly 30% of global consumers said they had conducted such a transaction.

Download the Consumers & Convergence IV July 2010 (PDF, 6MB) for more insight.

![]() photo credit: blakespot

photo credit: blakespot

Technology has become a major device for development. Phone application generates a very distinct worth for financial transactions this days. Because of its convenience benefit, it has set a new trend not only in communication but also in various aspects like finance and business dealings. Innovation really paved a way in successful transmission of relevant information.

The PDF downloaded seems to be corrupted. It cannot be opened. I would appreciate if you could email me the same.

Thanks and regards,

Akbar