The paranoia of banks failing has died down somewhat since the depths of the recession, when savers up and down the country were busy making sure that they didn’t have more than £50,000 in one bank.

By doing this, they were ensuring that they would receive their full savings back from the Financial Services Compensation Scheme.

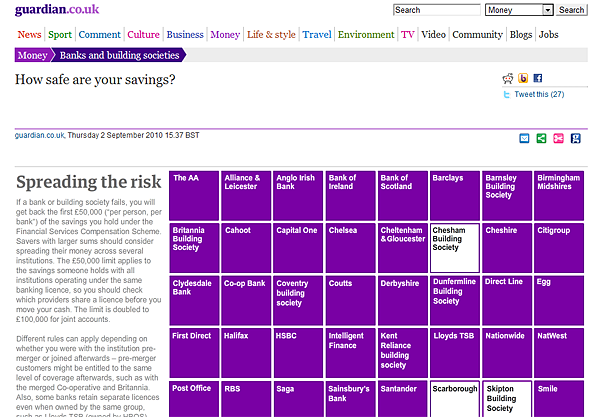

However, there was a catch. Not all banks were treated as seperate entities. For example, did you know that The AA, Bank of Scotland, Birmingham Midshires, Halifax, IF and Saga all share the same banking licence? So if you had more than £50,000 in any mix of these banks, you’d only be covered for the first £50,000 (doubled to £100,000 for joint accounts).

With the number of mergers and acquisitions in the banking industry, it’s a little difficult to keep track of which banks share a licence. So for those who are still worried about spreading their savings in the safest way, the Guardian has a useful tool for finding out. Just hover over the bank you’re interested in, and it will show which other banks are under the same licence.

Now get moving that cash around!

I had no idea of this. Very good information that if things did hit the fan could save alot of heartache. Thanks!