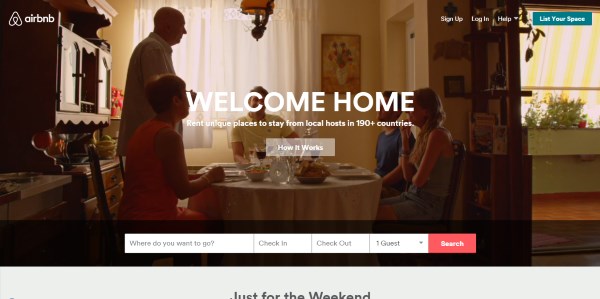

The last few years have seen a boom in social travel sites including Airbnb, Wimdu and Couchsurfing. which link travellers with people willing to rent out their sofa, spare room or entire home. But Gocompare.com Home Insurance is warning people to check with their home insurer, landlord or mortgage provider before signing-up as home-hosts – otherwise they may risk invalidating their insurance and breaking the terms of their lease or mortgage agreement.

Ben Wilson, from Gocompare.com Home Insurance, explained:

“Airbnb and other social travel websites have become hugely popular in recent years. Airbnb alone has over 1,000 properties listed for rent in the UK and many people use the site to earn extra income from their homes. But welcoming paying guests into your home, without first checking the implications for your home insurance, lease or mortgage, could be a costly mistake.

“Premiums for household buildings and contents insurance are partly based on who lives in the property and what the property is used for – whether it’s just your family home or you also run a business from home. So your insurer will want to know if you plan to let out your home in part or entirely, even on a short-term basis, and may refuse cover, charge an extra premium or put restrictions the cover provided. For instance, cover for theft may be excluded unless there are signs of a break in.

“You should also check whether you have public liability cover with your home insurance which generally covers you if anyone injures themselves on or around your property.

“If you don’t tell your insurer and need to make a claim, for example for damage to your walls, plumbing or furniture, or for a theft from your home, then your insurer may refuse to pay the claim and your insurance could be invalidated.

Ben Wilson continued:

“If you own your home with the help of a mortgage, then you’ll need to check with your lender to make sure that being a home-host, which is essentially a short-term let, doesn’t breach the terms of your mortgage agreement. Likewise, if you rent your property, you may need permission from your landlord and will need to make sure that you’re not breaking the terms of your tenancy agreement.

“While being a home-host can be a good way of generating extra income from your home, it could also severely damage your household finances. Therefore we strongly advise people to contact their insurer, landlord or mortgage provider before welcoming any paying guests.â€