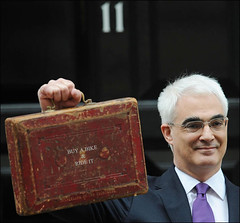

If you’ve somehow managed to miss all of the coverage of today’s pre-Budget report (which is effectively a Budget in its own right now), here’s a round-up of the main points from Alastair Darling’s speech, and how they might affect you.

- VAT reduced to 15% – the 2.5% reduction on value added tax will start from next Monday, 1st December, and will last until the end of 2009. The aim of this is to stimulate people to buy more, but that depends on whether retailers pass on this saving in the price of their goods (the Government “urges” them to do so, but probably can’t enforce it). Some estimates suggest that this could save the average family £10 per week. Not exactly a fortune to start spending to save the economy. Remember, there is no VAT on food, so there won’t be many savings made on your weekly shop. Interestingly, VAT on utilities, which is at the reduced rate of 5%, will also be cut by 2.5%, meaning electricity and gas bills should fall, all other things being equal.

- Increased tax on booze, fags and petrol – whilst VAT is reduced, you won’t be able to spend more on the things you love most, booze and fags. The tax on tobacco, alcohol and petrol will be increased to offset the VAT reduction.

- Income tax up – from April 2011 there will be a new 45% band of income tax, for those who are unfortunate enough to earn over £150,000 per year (1% of people, apparently). For those of us who have had the £120 tax rebate this year, this will continue for good and will be raised to £145.

- National Insurance – also from April 2011 all National Insurance contributions will be raised by 0.5%.

- Fuel duty up 2p per litre – this tax raise on petrol was delayed when petrol prices were soaring a while ago, but now prices have dropped significantly, the increase will be bought in from 1st December. Hopefully the price of oil will fall even more, bringing the price of petrol down further and hiding the duty rise. A further 2p will be added next April.

- Child Benefit rise – the rise in Child Benefit from £18.80 to £20 per week has been brought forward 3 months and will now start in January. For the second child (or subsequent children) benefits will rise by 65p per week, to £13.20.

- Help for those struggling with mortgage – for people struggling to make their mortgage repayments there are new rules to make lenders wait 3 months before they start repossession proceedings.

Further reading

There is naturally a masses of comment on the report, here are some of the better resources worth reading to find out more details:

- At a glance: pre-Budget report

- Pre-Budget Report: The Documents

- BBC: Pre-Budget Report 2008

- Telegraph: Pre-Budget Report 2008

- Guardian: Pre-Budget Report At A Glance