Imagine alerting your friends of the details of every purchase you made on your credit card. How would your buying change, and what purchases would you try to hide? How could it help you save money in the future?

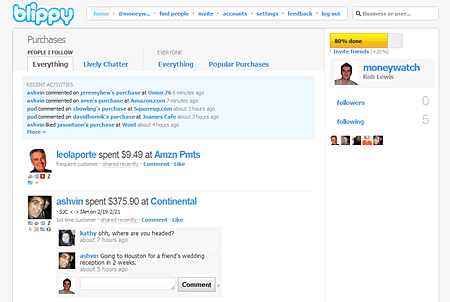

Well, a new Twitter-like service, Blippy, will let you find out.

Blippy allows you to publish data from certain credit and debit cards and online retailers, such as iTunes and eBay.

On the face of it, this will probably horrify you with the openness of the data, and how it allows even more intrusion into your daily life. You can pick and choose which accounts or cards you show transactions for, so you can be selective, and if you make a purchase that you’d rather not show off, you can delete it from your feed. Or you can just not sign up for Blippy in the first place!

But where Blippy has real potential is for tracking spending, spotting trends and potentially letting you know when you’re being ripped off. NetBanker has some more Blippy features and benefits, including:

Data sharing within workgroups:

- Ability to share financial transactions within a family, a workgroup, or small business. It would be a great way for financial gatekeepers, e.g., the bookkeeper, CFO, or even board members/investors to keep tabs on company spending.

- Ability to annotate expense streams. Users can add short descriptions to expense items so their followers can see the specifics.

- Ability to discuss/comment on expense items. For example, CFO can ask “why did our Google AdWords expense spike yesterday?” and anyone in the group can comment back with an answer or speculation.

Product research/social networking:

- Ability to find other customers of the same store

- Ability to discuss product or media purchases with friends or strangers

- Ability to post positive/negative info about purchases (yours or others)

- Ability to find previous purchasers of a product you are considering (currently not supported through search)

- Ability to compare how much people paid for a certain item (not currently supported through search)

Personal financial management:

- Ability to annotate expenses for future reporting (e.g., marking taxable items)

- Store transactions free for as long as Blippy keeps the servers running

- Ability to search own transactions

There more about Blippy over at TechCrunch.

Some personal finance management sites, such as Yodlee, Kublax and Mint, already allow you you to keep track of your credit card spending, but this adds a level of data and interaction which is currently unavailable in those tools – I expect to see Blippy or Blippy-like features integrated into them in the future.

So, can you see yourself signing up for Blippy? Despite the possible benefits, I’m not sure it is something I will be making much use of, certainly for now (although I said that about Twitter, and am now following over 1,000 people), but I do have a Blippy account, should you wish to follow any transactions I put on there.

Let us know your thoughts in the comments below.

![]() photo credit: qthrul

photo credit: qthrul