If you fancy yourself as the next Peter Jones, Duncan Bannatyne or God-forbid Deborah Meadon, then Crowdcube offers you the chance of becoming a “Dragon”, Â investing your money in start-up businesses.

Crowdcube claims to be the first “crowdfunding” website in the world to provide investors with equity instead of rewards, giving them a stake in, hopefully, the future success of a small business. By investing from as little as £10, people can receive shares in any start-up or growing business registered on the Crowdcube website.

Crowdcube provides a platform for entrepreneurs of start-ups and growing businesses to connect with potential investors and uses the web-based notion of ‘crowdfunding’ where a community of like-minded people pool their money and knowledge together to back an idea, business or person.  The website has been approved for its equity-based funding model by FSA approved company Bishop Fleming. The legal framework was developed in partnership with Ashfords LLP.

Darren Westlake, co-founder and Managing Director says, “Crowdcube gives ordinary people the chance to become ‘Armchair Dragons’ by investing modest sums of money in exciting business opportunities. By leveraging the power of the ‘crowd’ to pool small amounts of investment money, we can give Britain’s start-ups a much needed boost and crowdfund Britain’s economic recovery. Small businesses are Britain’s future, so we’re letting people play a vital community role by supporting businesses that inspire them as well as giving them more control of their own financial prosperity.”

How does Crowdcube work?

If you’re looking to invest in a start-up business, you’ll first need to register and transfer some funds into your Crowdcube account.

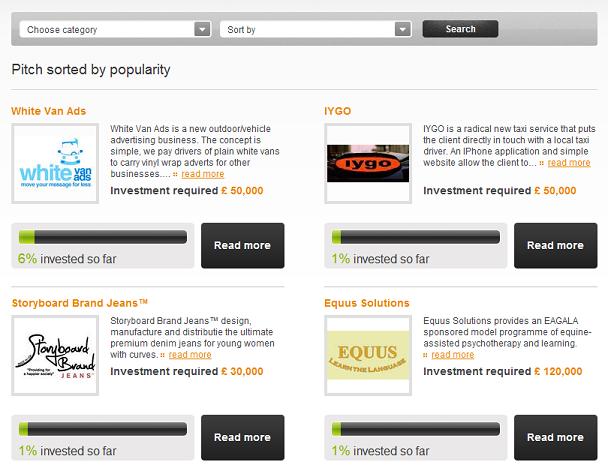

You can then browse and filter Crowdcube’s directory of businesses looking for investment. You can also see how much of their target investment they’ve achieved:

If you’re interested in a business you can click through to find out how much investment they’re looking for in total, how much they’ve raised and how many other investors have committed money to the business.

Registered users get more detail on the businesses, including information, such as biographies and videos on the owners and access to documents such as profit and loss accounts, cashflow forecasts and balance sheets.

Crowdcube  encourages you to share the details of the business with your friends on social media sites such as Twitter and Facebook.

Once the investment target finance is met and monies transferred, investors receive shares and equity in the business with full dividend rights. If the target investment amount is not met, investors get their money returned. Here’s the full list of benefits Crowdcube promises you’ll get as an investor:

- a reward from the entrepreneur to say thank you

- direct equity in the business

- to build your own investment portfolio

- a return on your equity if the company is sold, bought out or floated on the stock exchange

- to back UK businesses that you want to be a success

- the opportunity to give feedback and get involved in the business

Verdict

Crowdcube will appeal to those of us who enjoy watching Dragon’s Den whilst thinking that we could do a better job than the Dragons themselves, but of course the reality of investing your own, real money, could be much different.

There aren’t many investment warnings on the Crowdcube website, yet when you register you’re made to understand and accept that the investment opportunities are “not authorised by FSA authorised persons and it is your responsibility to perform all due diligence prior to investing in an opportunity”. You need to remember that these are start-up businesses and so the risk of losing your money will be pretty high – you should think carefully before committing funds to such young businesses.

However, the fact that the minimum investment is so small means that you could “dip your toe in” to try it out without too much commitment, and it’s definitely a good use of the idea of crowdfunding, connecting cash-hungry small businesses with investors willing to risk their money.