Thousands of Halifax and Bank Of Scotland customers have experienced problems accessing their bank accounts information online, since a botched integration courtesy of owners Lloyds at the weekend.

At the start of the week customers were able to login to their accounts but they could only view a limited statement. Lloyds issued the following enlightening statement:

“We’re aware that there is currently an issue that means that customers cannot see a full history of their transactions when they log into their online banking.

“We’re sorry for the inconvenience that this is causing, it will be resolved as soon as possible.”

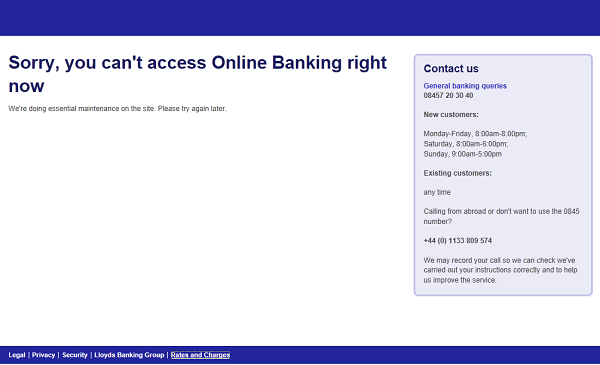

As of Wednesday night, Halifax still appears to be having problems:

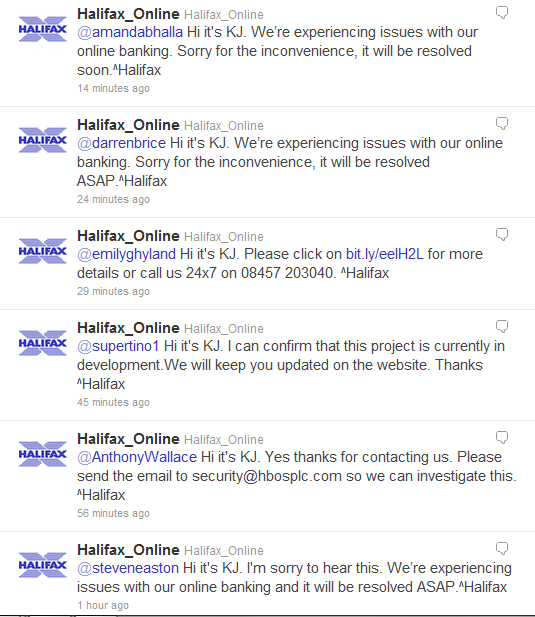

Throughout Wednesday, Halifax’s official Twitter feed was apologising to customers struggling to access their accounts:

Sadly, their apologies were probably not well received by those looking to make urgent transfers, and the vague ASAP given in several tweets was disconcertingly vague, and largely useless.

We’re trying to find out if the continuing problems are related to those problems caused by the integration over the weekend, and whether there is a timescale for resolution, and will update this post if we find out more.

We are still waiting for our security token, without which you cannot use the Halifax bank of scotland business banking, which should have been received before 05.09.11 – I have rung the ‘helplines’ continuously all this week and we still have no token.

We are therefore unable to pay wages this week – our staff are well pleased, NOT. – TOTAL DISGRACE!!!

My staff thought Christmas had come early. Payment of wages debited from our account on Friday were then duplicated on Monday after the upgrade. Although BoS has now recredited us, it will have to go put requests into my employees’ banks to ask for the money back. The cynic in me says that this was part of the reason why statements could not be shown – it would bring in a flood of telephone calls from business customers wondering why all their payments had been duplicated and their bank balances were too low!

It is a ridiculous situation when banks with all the money and resources at their disposal cannot even test their integration before going live.

I have stated a Facebook Page for customers to discuss this if anybody is interested. I have called it Rank Of Scotland!

http://ow.ly/6v4WE

Andy

An associate of mine has confirmed that this is the third attempt at rolling out this new system. The previous two attempts barely got off the ground with major failures. There is little trust in the new system being able to cope.

This sounds appalling bad! I’m a big believer in Twitter, but is it really the way forward for bank. Sounds not when dealing with mass #fail

Cant log into the business account “Technical problem”. I have bills to pay and will be in deep trouble if I cant get to the site soon, I still have no Token to replace the old one. If I could I would change to another bank. no one can tell me how long to resolve the issue it a disgrace that the technical team are not able to resolve this in a respectable time i.e hours not weeks.

Day ten and still no access – and still no recognition that this is a problem.

With no access to account and no cheque book I have NO choice but not to pay bills that are coming due –

Time to go back to a biscuit tin under the bed I’m afraid

I’m one of the lucky ones, I can at least log in although it takes longer than waiting in a queue at the bank to do so. About 6 minutes just now, nearly 9pm, just to get through the first two screens. Telephone banking had me through security (once I got through the 3 minutes of call centre idiot questions) in under 20 seconds. Different system, they told me.

The screens redraw themselves about three or four times while new bits of graphic dribble in – have a cup of coffee, don’t rush or the mouse click will be in the wrong box (just like the Lloyds on-line system has always been). Why replace an award winning, almost perfect and very responsive system with this stone-age computer game stuff? All the annoying extras on the screen seem to be handles to allow the bank to put all their product offerings at your fingertips, while stopping you using the product you subscribed to!

An appalling botch.

Spoke too soon. Can (eventually) see statement but can’t download statement as .csv (error message “unable to download file _exportstatement_fallback.jsp from (BoS) website. The requested site is either unavailable or cannot be found. Please try again later”)

Have they removed file https://secure-business.bankofscotland.co.uk/business/a/viewproductdetails/m44_exportstatement_fallback.jsp on purpose I wonder??

Why change things when the system isn’t broke?

What Cretins can introduce a new system without running the two side by side and ensuring the bugs are out?

With the new software you do not have a history of payment to suppliers.

You cannot print out a receipt for payments made.

A realy crass system.

If I was in charge there would be a big boot up the ass for whoever was involved.

Well, it’s now over 2 weeks since this farce began and still no resolution.

Over the last two weekends (I only look at this account at a weekend), naive fool that I am, I have tried to use their ‘helpdesk’. Of course, the phone numbers on the web site are incorrect. And when using the ‘correct’ one, given to me by one helpdesk member, that also turns out to be wrong as the number re-routes to someone who doesn’t do this. So much for a none-stop shop.

When I eventually got to someone I requested they email the details she can see, the actual database will almost certainly be on an IBM mainframe (re badged as a server in these mickey-mouse IT days) running IMS or a descendant with a web-server front-ending it for the oiks. She asked me some security questions, fair enough, that involved how many accounts I have. So I told her. Wrong number!!!

With this farce and the fact they see a different number of accounts to me (the other accounts I believe I have are visible to me) I wonder how secure their (Lloyds) IT really is.

Anyway, in a previous life I have tested online banking systems and yes you would have a copy of the production system. Not only hardware and software but also develop a statistical model of what users do. This problem should have manifest itself then.

But I’m not surprised. Every single time I deal with the Halifax they get it wrong first time. 100% faiiure to get it right first time.

And for those who are not sufficiently aware, their ISA cash product is rather good for availability and serves as a decent emergencu fund but they can’t resist trying to stich you uo by dropping the rate to virtually 0 every 12 months. That means you then have to go through a performance to get the rate back up.

I suspect they feel they really are masters of the universe.

I went to the local branch to ask when I would be able to view my accounts online and the bank teller told me nothing except that they were in the middle of upgrading. It’s not really a good answer to a customer. I’m so glad I opened by business account with HSBC. I think I’ll move the rest of the accounts there too. Bank of Scotland’s not what it used to be.

I too am experiencing problems with my Halifax online account. Have been an online customer for several years, but every change they make, results in a system that may be more secure, but less easy to use. For the last 3 weeks I’ve been unable to see my statements. After complaining and getting £20.00 compensation (twice – they must have money to burn or perhaps they could pay for better IT people who can resolve the recent glitches in the system as I gather I am not alone in having this problem), I can now get a limited statement but to get earlier ones I have to use the somewhat ambiguous search process at the bottom of the statement screen. Not good enough and I’m also fed of of getting the message “high call volume” when I ring up (why not email for online queries?) and if I see that sickening ad they keep showing any more…..

My wife and I have separate Halifax accounts for tax reasons and today I tried to log in to check our accounts, mine worked as usual but it wouldn’t accept my wife’s log-in details, got rejected a few times and was told to phone and give a reference No.

The person on the phone asked questions like what day did you first open your ISA, well, she has quite a few ISAs and they’ve been transferred a few times over the years as the interest dropped so we weren’t sure of the answer but we did answer other security questions correctly.

Despite having a current account statement in front of us with loads of transaction details, direct debit details etc it still wasn’t enough for them so now we have to wait for different log-in details to arrive by post, as it happens it wasn’t urgent in our case but what if we needed to access money urgently?.

It just isn’t working is it, once you’ve signed up for online banking and have successfully logged in that should be that and it should work forever afterwards.

Does anybody know if this matter has been resolved???

Everytime i log into my online banking, it lets me look at my statement. When i try to check my direct debits and standing orders, it signs me out with a message saying “sorry, we had to log you out.” then i cant sign back in again. Absolutely useless!!!!

As a new credit card customer I am unable to register for online banking. This is a major frustration for me as accessing my most up to date balance is crucial in my budget management throughout the month, and I also tend to prefer paperless statements. It has left a bitter taste in my mouth and a huge sense of relief that I did not bother transferring my current account.

I have had huge problems in the past with a previous account with Lloyds TSB and would never have even applied for a credit card with Halifax had I known they were in any way linked with them. Unfortunately I have already transferred my credit card balance and so will have to put up with this service until I have paid off my credit card. But there is little hope of me staying with Halifax beyond that period. The online banking helpline offered little in the way of help, and said that all I could do was keep trying to register. It is tedious enough as it is without having to continually type in my details to see if they have sorted themselves out.

Quite frankly it’s just not good enough. I’m sure there will be little in the way of understanding if people’s payments are late.

Halifax have also just changed their business banking statements. They now issue 4 or more pieces of paper where they used to issue just 2. The same information that has been provided for years is now spread out over more paper. The back of each sheet of paper has identical pre-printed ‘Useful information’ on every single sheet. So much for having an envirnomental policy!

I made a formal complaint and was given the brush off, ending with a letter that says ‘there are no plans to change this new format’. Time to vote with my feet and take my business banking to another bank.