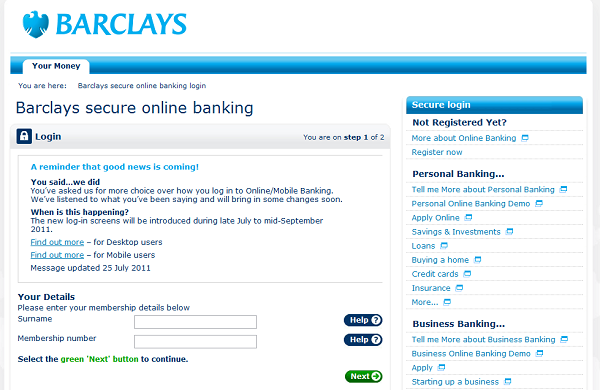

A few months ago we reported on Barclays announcing changes to their internet and mobile banking login process, and today they’ve confirmed some of the improvements they’re making, and when they’ll be available:

- A simpler log-in process that’s more flexible to customer needs.

- More log-in options so that customers can choose the one that suits them best.

- If you have a PINsentry, you’ll be able to carry out a wider range of transactions without it.

- Those that don’t want to carry their PINsentry card reader everywhere will be able to set up a memorable word and passcode to gain access without your card reader to many Online Banking services. You’ll be able to see your balances, transfer money between your Barclays accounts and make payments to people and companies you have paid before through Online Banking. However, payees on first-time payments will have to appear on a pre-approved list if PINsentry is not used.

- As an alternative to using your Online Banking membership number, you will soon be able to log in using your sort code and account number, or your Barclays debit card/cash card/authentication card number.

We’ve seen from the comments about the recently introduced HSBC Secure Key, that customers aren’t very keen on having to carry around extra items just to let them login to their online banking accounts, and so this is a good move from Barclays, recognising that not all types of visit should require a full login process.

The changes are to be rolled out to Barclays customers gradually and will be introduced between now and mid-September. More details can be found on the Barclays website.

I think mobile and online banking is a brilliant idea, for most working people especially with children it’s such a chore going to the local bank!

Online banking is usually done through an encrypted connection so that hackers cannot read transmitted data, but consider the consequences if your mobile device is stolen. While all banking applications require you to enter a password or PIN, many people configure their mobile devices to save passwords, or use insecure passwords and PINs that are easy to guess.

Many consumers use mobile banking on their cell phones or other portable device because it allows them to quickly access information such as account balance and transaction history. The benefits of this convenience are undeniable, but there are a number of disadvantages that mobile banking users should be aware of. The technology’s cost, compatibility issues and security problems may cause you to think twice about using it.

Barclays online is shit service, all previous reviews are spam and come from payed review makers payed for by barclays.

Their online banking system fails and is not secure save.

Dont use lloyds either.

I am wondering about the security of Barclays PINsentry device.

Suppose someone cloned or stole my card.

Could they not use a PINsentry device and pretend to be me