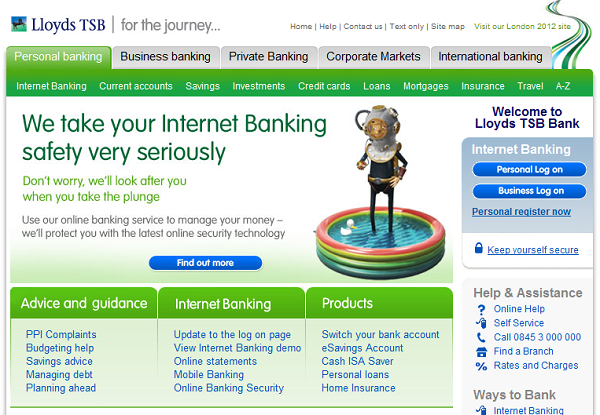

The Lloyds Banking Group is set to relaunch the websites of Lloyds TSB, Halifax and Bank Of Scotland later in the year, in a push to improve its online presence.

According to Marketing Magazine, the sites have been redesigned with a focus on the customer experience, to make the sites more usable and add more financial education and community elements, and are due to be launched in November.

The redesigns are part of a four-year project (“Galaxy”) which is being carried out by its digital agency. Earlier in the year Lloyds launched their Money Manager tool to help clients manage their spending.

Lloyds TSB are also said to be introducing a “mobile browser app” later in the year (so more likely to be a mobile-optimised website for use on most types of smartphone, rather than seperate iPhone/Android apps).

If you’re a customer of any of these Lloyds brands, we’d like to know your thoughts on what you feel they could improve with their online banking tools. Let us know in the comments below.

I am a Bank of Scotland customer and would absolutely love an easy personal banking App for my IPhone instead of having to go to the hassle of going online to check my balance and transfer money, this is fine when sitting at my desk on front of my computer but when I’m on the go it really isn’t a quick task trying to navigate your way through the Bank of Scotland website on your IPhone. If they are looking to improve their customer experience then I think an App is most definitely the way forward.

Couldn’t disagree more. iPhone owners are still a minority of smartphone users. By making a mobile-optimised website instead they are covering a much larger audience.

Totally agree Hannah. After seeing apps from other banks already, would really like an app. There are already bank apps available for more than 1 platform. Mobile optimised is fine but i find the streamlining cuts out what you could really do. An app can provide more security (if set up properly), can reduce data usage by having all the higher-end graphical elements contained within it to make a good user interface (rather than the barebones mobile optimised site), can incorporate standard budgeting tools and bank information, can provide notifications and alerts from the bank/app as well as your own reminders for payments etc. The benefits of having an app are pretty obvious and the way I hope BoS go. I’d be in my account more

With Apple’s tight control over app quality i think companies often start there. Android is more open but also more susceptible to virus/malware which isn’t ideal, particularly if using banking software. Of course the more accessible you want to make your banking, often the more chance of a security risk there is, no matter what device.

Hi there, when are you going to launch Halifax bank app for iPhone ?

Can’t wait come on guys

I have an iPhone and the new mobile optimised website is gay my phone is fast enough and the screen big enough to us the standard display, if your gonna atleast do something y not give us an app then we can chose to use the app or not, I do not like the mobile optimised layout and as a result willard me bank less and that kinda wasn’t your plan

I have been with BoS for 40 years. Ashley Machin’s “improved online service” meant I was without online access to my accounts for 16 weeks. I wrote to him personally asking if he would resign, as the slightly more honourable BA operations director did after the Terminal 5 shambles. No reply. Complained officially. Told that FSA gave them 8 weeks to respond. It’s now 17 weeks and nothing. Bet he’s due a big bonus and the FSA a gold star. Dear God.

I’m with Hannah re the iPhone App for B.O.S. I opened my account in 1961,(as British Linen Bank)and they appear to have made few advances with regard to customer access to their services over the last 50 years. Checking accounts and transferring cash on line is a lengthy, time consuming and over complicated process. Take a leaf out of R.B.S’s book guys and let’s have a super efficient, secure and easy app for The Bank of Scotland. Loyalty counts for little now and ‘he’ who provides the best,reliable,easy to use service at a competitive price gets the business!