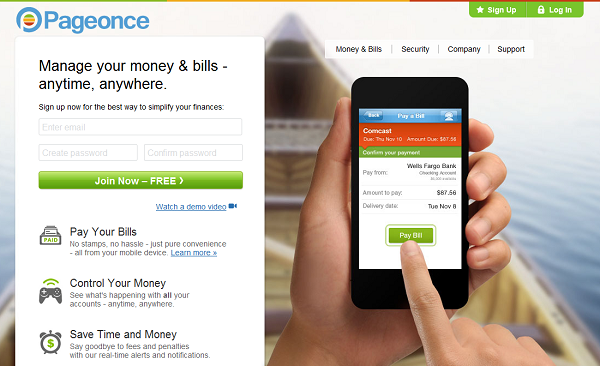

We’ve taken a look at Pageonce, a web and app-based account aggregator with over 4 million users, which promises to help manage your money and bills.

Account opening

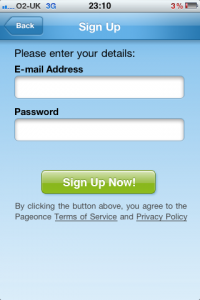

You can open a Pageonce account with a minimum of details, either online or within the app. You’ll need just your email address and password. On the website they also request your Zip code, a nod to the fact that Pageonce is primarily aimed at a US audience (I believe the Zip code is used to tailor local deals within the free app).

Account sign up on the iPhone app:

Adding accounts

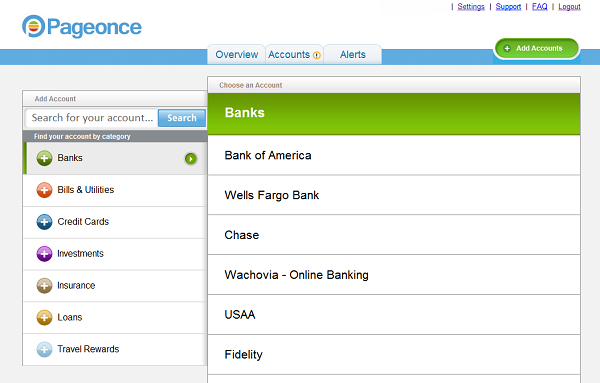

Once signed up, you can then start to add your accounts.

UK banks are pretty well covered, with all of the major high street banks available (Lloyds, Halifax, HSBC etc.) and can be added either on the website or through your smartphone app (the app is available for pretty much the full range of devices; iPhone, iPad, Android, Blackberry and Windows Mobile).

In most cases, you’ll have to search for your accounts, as the default list contains mainly US institutions (apparently Pageonce supports over 6,000 different accounts).

Once you find the account, you’ll need to enter your login details for the online banking account you wish to add, so that Pageonce can go off and download your data, and it will do this at regular intervals to keep the data up-to-date. If you feel uncomfortable doing this, then this type of tool probably isn’t for you (although we suggest you read the security information below).

Credit cards, insurance and loan accounts appear to be less well supported for UK institutions, whilst the bill pay function appears to be available for those who upgrade to the iPhone / Android Pageonce Gold app.

If you cannot find the account you wish to add, you can request for it be added, but Pageonce say that they will add accounts based on the number of people requesting them, so you may have a wait before they appear, especially for less popular providers.

View your accounts

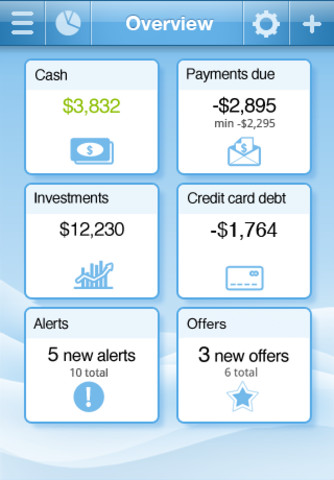

Once you’ve got your accounts setup, logging in to either the app or the website will show you a summary of the balances of your accounts, with the example below from the iPhone version:

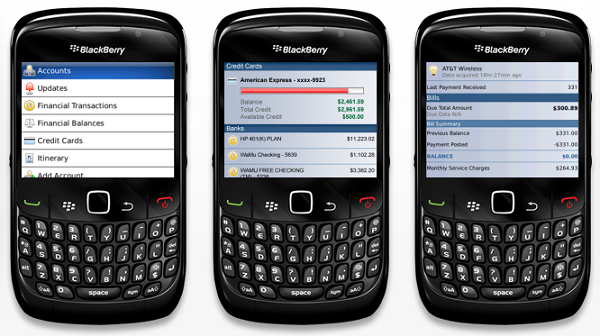

Here’s some screenshots from the Blackberry version:

You can click on the categories (cash, credit cards etc) to see the balance of the accounts in that category, and then click on each account to see a pretty basic list of the recent transactions on that account.

It’s slightly annoying that they do not seem to support a £ sign as yet (and it’s been that case since the iPhone app was launched last July), so if you use the app you’ll have to get used to seeing all your accounts in $. A minor gripe, but you’d have thought it would have been fixed by now.

Notifications

For each account you can set whether or not you wish to receive notifications, either within the app, on the website or via email, when there is a major change in the account, such as £500 (or as they put it $500) deposited or withdrawn.

Security

Pageonce is naturally concerned with the security of its website and apps, and claims to meet the highest standards in internet security and are “just as secure, if not more secure, than major banks”. They also meet the requirements of the likes of Verisign and McAfee, third-parties who independently check their security and privacy systems. Peace of mind as you’re entrusting them with extremely important information to access your online banking accounts.

Pageonce has a feature allowing you to destruct your data from the website if you were to lose your phone. You can choose whether to have Pageonce login automatically or when you enter your username and password on the phone, but we’d always urge you to be as cautious as possible. Automatic login is useful, but we only recommend using that if you’re using a PIN code on your phone, so you at least have one line of defence.

Your usernames and passwords are never displayed after you enter them during the login process, so the chances of anyone getting access to your accounts if you lose your phone are slim.

You are also able to minimise access to your mobile device should you wish to, so there are a number of ways that you can minimise the chances of anyone getting hold of your data.

Verdict

The app and website are pretty good looking and easy to use, without really doing anything too special. The number of devices supported (and the fact that you can access your data online too) is excellent, as other similar tools tend to concentrate on the iPhone. The security features and alerts are reassuring, and the coverage of UK banks is good but the app is somewhat let down by the apparent lack of other types of UK institution.

It would also be useful to find out a bit more about what the paid-for Pageonce Gold subscription gives you for your money, with this information lacking or very well hidden on their website. It might be included in the app, but as the battery on my iPhone has just died, I’ll have to wait for tomorrow to find out.

I have upgraded to Gold last week. Until now I am not able to pay by bills through the app. Technical support is not helping to resolve the issue. I thought its a waist of money having the upgrade.

I am for more than one month trying to recover my password without success up to the point I asked to delete my account in order Pageonce do not have access anymore to my registered bill accounts. However, I still receiving automatic e-mail from Pageonce from new bills to pay indicating that my account is not closed. I begged Pageonce to close the account, and the support even answer my e-mails anymore. I tried to send e-mails to the info and to the sales without any success. The support does not answer and you do not have any higher instance that you can talk to. It seems that the only way I will have to stop Pageonce to have access to my accounts it will be to reset the password of all my accounts registered on Pageonce. I will never thrust in a service like this anymore. The idea is wonderful, but the lack of support is terrible mainly counting that you thrust some important and confidential information to a third company to handle it.

Hi

The HSBC (UK) is not covered. You can;t find it in the list.