Consumers in the UK save an average of 34 years in time every month by paying for goods with contactless cards, a study released today has found.

It takes the average person less than five seconds to transact when using a contactless payment card, with this time-span doubling for payments using a chip and PIN card.

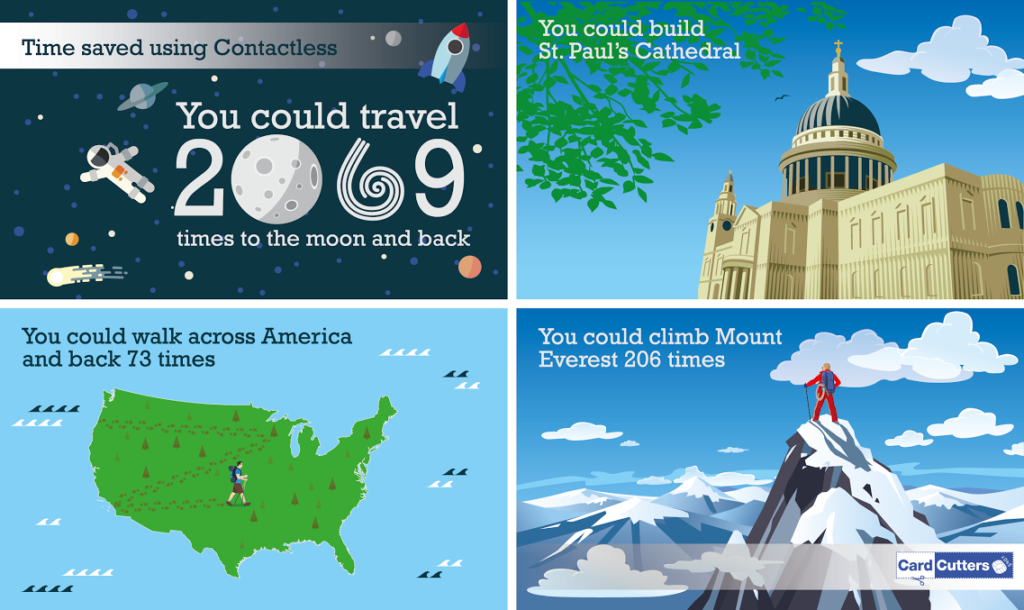

There are 218 million* contactless transactions every month in the UK meaning that more time than ever is being saved at the till, the equivalent to 34 years – or enough time to fly to the moon and back 2069 times.

The study by card payment machine provider, Card Cutters, also found that consumers in Wales are the quickest on the tap, with more people here (68%) taking under five seconds to use contactless. At the other end of the scale queues at the till in Northern Ireland can be expected to be considerably longer, with less than half of customers (47%) here taking five seconds or less.

It’s not only regions that can affect the speed people tap their contactless, either, with age also playing its part. However, it’s not millennials leading the way as may have been expected, instead more 55-65 year olds take under five seconds when paying.

To see the full results of Card Cutters’ study, click here. Other findings include:

- Women pay quicker using contactless than men (71% versus 65% taking under five seconds)

- 53% of those using chip and PIN cards take longer than 10 seconds to pay

- Other things you could do in the 34 years the UK saves every month include:

- Walk across and back the USA 73 times

- Build St Paul’s Cathedral

- Climb Mount Everest 206 times

Paul Edwards, Card Cutters UK Director, said:

“We believe the amount of time people save using contactless is very important. Currently people can purchase items valued up to £30; but with Apple and Android pay this could all change in the near future and the maximum spend could rise again.

“As we’ve seen, a huge amount of money is spent using contactless payments on a monthly basis in the UK and it’s safe to say the great appeal of it is the speed and ease of just tapping a screen rather than typing in a PIN. Our study backs this theory up – you’re going to spend twice as long staring at a card payment machine using chip and PIN.â€

*The UK Cards Association