Following my post on Osper a few days ago, a similar service offering pre-paid debit cards to children, goHenry, was bought to my attention.

I hadn’t realised that I’d actually blogged about goHenry before, at the start of 2013, following its launch in November 2013, when it was known by its previous name, PKTMNY.

Over the 18 months since launch, goHenry has been working with its user base to develop and enhance the features of the app and website that hopes to teach children about money. Its efforts have recently been rewarded by 50,000 parents at the Loved by Parents awards who voted goHenry the Best Family App and it was recently featured in Money Saving Expert as the best pre-paid card for teenagers.

According to goHenry, the main differences between itself and Osper are:

- goHenry’s app features are visually more appealing and further developed thanks to feedback from parents

- goHenry has been working with special interest groups such as the government backed agency Money Advice Service and Pfeg (the the UK’s leading financial education charity) to shape its service and inform its opinions on the subject

- goHenry has many partnerships with schools. For example, it is working with two schools to help them go ‘cashless’ and allow pupils to buy everything during term time (such as school dinners) using goHenry.

goHenry has taken a very different route to market to Osper. Founded by parents, goHenry raised capital from private investors and until recently had only engaged in limited PR activity.

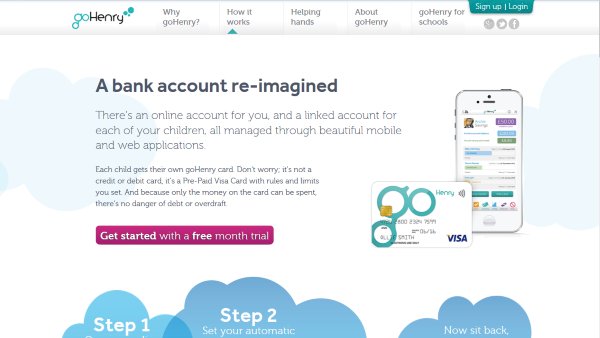

In terms of functionality, goHenry appears to have a more developed offering. Here are some of its features:

- Set up regular pocket money transfers and make one-off payments to your children

- Set tasks so your children can earn a little more

- Invite your relatives to contribute to your children’s savings

- Set single and weekly spending limits

- Decide where each card can be used: in shops, on-line or at cash machines

- Block and unblock cards instantly, without a phone call

- View how and where they spend in real time

goHenry is backed by VISA, as opposed to Osper using Mastercard, so there may be some differences in where the money can be spent.

Charges

As for charges, whilst Osper’s main fee is £10 per year per child (with the first year free), goHenry charges £1.97 per month (the first month is free, but that still adds up to £21.67 for the first year, £23.64 per year thereafter) as its main charge (this has changed quite a bit since our post on PKTMNY in 2013).

Both services have a few additional fees for using their cards in certain ways. However, if your child avoids using either card abroad and avoids losing the card, then there shouldn’t be too many further charges for their use. You can find out more about goHenry’s charges here, whilst Osper’s are here.

Verdict

As I mention above, goHenry seems to have the better offering at present, with greater functionality available to parents for managing their child’s money, yet the monthly charges do add up over the course of a year, so for kids earning a couple of pounds per week, as mine do, it’s quite a high price to pay.

As our 8 yo has a habit of mislaying things (incl. money) we decided to give Osper a try. It’s a brilliant idea – lots of fun for her and peace of mind for us. Doting grandparents love to send little surprise top ups too with sweet messages. I would highly recommend it… plus why give those greedy banks any more business ;) Here’s our code to get a free £5 top up on your little one’s (& ours) Osper card – HWI46083