Yesterday we questioned the $240 million valuation of mobile payment processor Square, and here are a few more reasons to question that value.

Intuit have also been providing businesses with card readers to attach to a mobile phone to enable quick and cheap credit card processing, but up until recently there was an initial charge for the device, unlike Square’s which was free.

In the last couple of days however, Intuit have removed the upfront fee (at least for a limited time, if not forever), and have moved from a monthly charge plus low transaction charges to a slightly higher transaction fee without the monthly charge. Although their per transaction charges have risen, they’re still cheaper than Square:

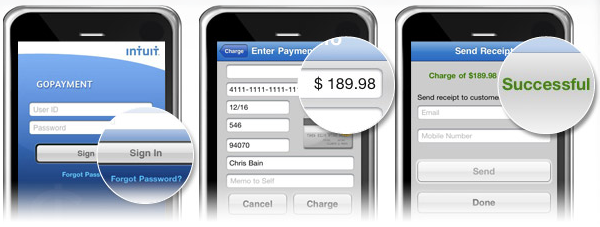

Intuit has decided to do away with the charge for the card reader, and to offer a new GoPayment plan with a free reader, which can be attached to many smartphones. The new GoPayment plan charges rates higher than the normal 1.7-percent, but still manages to be slightly cheaper than Square’s 2.75-percent, settling on a 2.7-percent fee for users of the free hardware and software package.

Square has had plenty of publicity in the online tech world because of its links with Twitter, and without any traditional advertising has apparently taken on 30,000 – 50,000 customers. Intuit is aiming to hit back with a TV and Youtube campaign, and has an established brand within the small business world because of its accounting software.

So is this a signal that the mobile payment battle is hotting up?

Well if it is, it could be pretty short-lived. There’s a feeling that these types of device will only be necessary between now and the time that NFC and similar technologies are widely integrated and used in mobile phones. This is likely to be at least another couple of years, with the most popular phones gaining the technology this year and then general usage slowly building.

CNNMoney also queries whether there’s really any money to be made in this space:

“Maybe there’s a reason why these types of businesses don’t already accept credit cards,” says Sean Harper, co-founder and CEO of FeeFighters, a comparison-shopping website for merchant accounts. “Maybe it’s because the incumbents [the banks who traditionally sell accounts and credit card terminals to businesses] have decided it’s not economical to market to them.”

Update: ReadWriteWeb does a good job of comparing 4 similar mobile credit card swipers.