Lloyds have dipped their toes into the world of personal finance management (PFM) with the launch of Money Manager, a new free tool for Lloyds account holders.

Here’s a video of it in action:

Money Manager is a free, easy-to-use Internet Banking service that introduces a new way of keeping track of your money across your Lloyds TSB personal current and credit card accounts.

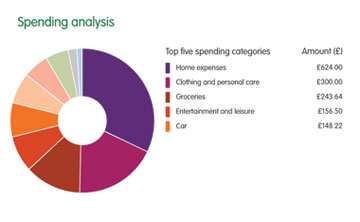

It automatically breaks down your spending into meaningful categories, such as entertainment, food and travel, using easy-to-read graphs that give you a fuller picture of where your money goes.

In essence this is a stripped down version of other PFM tools like Money Dashboard or Mint, but only allows you to track spending on your Lloyds current accounts, credit cards and most savings account, rather than all of your online bank accounts.

Whilst it doesn’t allow you to see all your accounts, it does automatically categorise your spending from as far back as 2 years ago, so it comes with some useful information from day one:

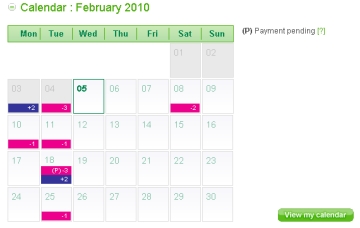

You can also choose your own categories if you wish. There’s also a neat calendar view to show when your money enters and leaves your account:

Whilst it might not give the complete view of your finances that other tools will, I think this is a good first step from Lloyds, and reckon it could be quite popular with its clients.

Lloyds TSB Money Manager will be available to existing Lloyds Internet Banking customers in the near future.

Having been a customer of Lloyds TSB for a good few years this is one of the first innovative developmens they have made in a fair while and it is really useful.

Thanks for the heads uo with it.

I keep being told this will be available soon but have no idea when. I keep checking my account but it could be weeks away, any ideas?

Having experimented with this new tool, I can say that although it does have some nice features, there are major flaws. For instance the spend only includes outgoings so a failed transfer will show as a spend even though there is a corresponding credit of the same amount. Also other transactions such as reimbursed expenses or fees cannot be netted out of the analysis.

Generally my attempts to catagorise spend that hadn’t been automatically recognized resulted in errors for around 1 in four attempts.

So although the tool may be helpful, it has far to go before it will be a really useful addition.

I’ve just tried to use this tool – unfortunately, it isn’t live against my account data, and so is of pretty limited utility.

Changing a transaction’s category is not immediately reflected on the dashboard, and no matter what I did, I could not allocate categories to my uncategorised transactions, the list stubbornly remaining unaffected.

Until this tool reflects changes I make immediately, I won’t be using it – it’s no good to me to have to wait til overnight til my dashboard summary is recalculated.

I have been using Lloyds online for around 5 years now. I was pleased to hear about this tool being released.

I too have experienced alot of difficulties with the tool.

– It does not updated when categories are changed.

– Sometimes unrelated expenses are jointed into a category when I apply it to one expense.

– The links don’t send you back to the view you had of the money dashboard which makes it annoying to have to go back to yearly view each time.

These and other defects make the tool unusable for now, I hope they will fix it as I would like to be able to use this tool.

Money Manager is, to be honest, pretty useless. You can create new sub categories within, say, “home expenses” – occasionally – but can’t create new main categories. So, my car running expenses go in “car”. My motorbike’s expenses also go in “car” and I can’t create another category for it. If I buy, say, a gas bottle at a garage, that will go under “car”. Cashpoint withdrawals being “undefined” seems a fairly major omission. Whereas most people are paid at the end of one month and spend it over the course of the next, MM can’t correlate that as it only works on calendar months. I transferred money from one account to another and then closed the first account, this came up as extra income instead of me just reshuffling money I already had. And so on.. Then when you eventually give up with it, there’s a number of screens to get through before you’re out of the damn thing again.

All fairly irrelevant at the moment, since it hasn’t worked at all for a few days now anyway!

I have written an article about online banking experiences, it would be interesting to hear your thoughts on the services you use and your thoughts on the Money Manger

http://www.3sixty.co.uk/our-thinking/finance/online-banking-experiences

Gotta love Money Manager, best way to keep track of your money. how much did you spend on food or other stuff. absolutely love it.

Yep, Money Manager is really great. Saves a lot of time and energy, I’m not sure if other banks have a feature such as Money Manager but I’m really happy I made a right choice. Love Lloyds

Doesn’t it make you feel guilty about what you are spending and where you are spending it?

Very worrying about the T&C and what happens with your data, i would like to keep my data protected thanks

I used this tool and it’s helpful for me…

Total waste of time. Biggest problem with this is that if you have your credit cards and current accounts with lloyds, the software records the expenditure you rack up on the card thru the month AND the credit card bill at the end as categporised expenditure. However it doesn’t then show the the money coming into the credit card account when you pay the bill. We put most of our monthly expenses on the duo airmile crdit card and then pay it off in full every month. As a result, money manager double counts all of our expenditure, so the analysis it offers is rubbish. I called them and asked if there was a way round this and they basically said I was an idiot for having all my accounts with Lloyds.

Be aware – if you lose your bank card or have to cancel it for any reason, such as an attempted fraud, all your Money Manager data for the past two years is lost. I had an attempted fraudulent transaction on my credit card, declined by the bank and when they alerted me to it and suggested I get a new card, they didn’t warn me of the loss of this data – or I’d have saved it all first before cancelling the card.