According to GigaOM, short-term lender Wonga might be in the early stages of planning to launch on the stock market.

Following an injection of £73m back in February of this year, they’re now talking to banks about either an IPO or securing more funding.

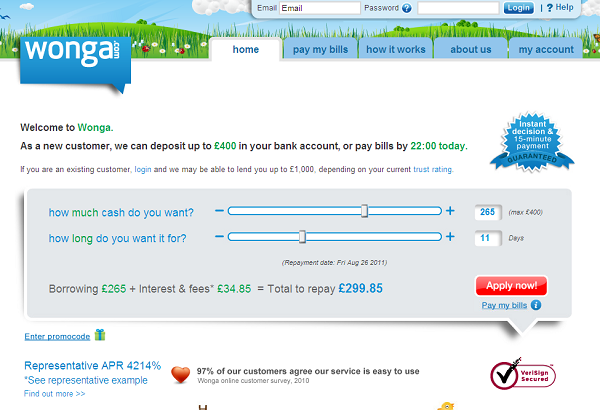

This could worry the payday loan opponents; Wonga has caused a fair amount of controversy in its short lifetime, as its short-term loans appear to have excrutiatingly high APRs, because of the way they have to report their rates (showing the cost over a year, even though they do not offer loans over this length of time). Together with this, they’re accused, rightly or wrongly, of targeting the most vulnerable borrowers in an as yet unregulated market, resulting in a “perfect storm” of bad debts.

If you can see past the controversial nature of Wonga’s lending, then behind these stories there is an innovative, technology-driven company, operating in a competitive, low-margin market. For a more balanced view of the operation, take a read of Chris Skinner’s recent article on Wonga, which shows how Wonga try to distinguish themselves from other payday loan companies.

Their latest adverts are, however, terrible:

It is the people who may use the floating version of Wonga that I worry for … the fall to the ground may hurt even harder!

The only way I have found thus far that Wonga seperate themselves from the rest of the payday loan industry is the amount of advertising they do !!!! Oh that and they sell your debt to a collector mid repayment plan without telling you; thanks Wonga!!

I also question the constant ramblings (mainly from Wonga) about their technology, its a farce! Certainly through speaking to people who have taken Wonga loans every week for 6 months, or those who have just taken Wonga loans for 11 months straight, each time increasing the amount borrowed to a nearly maximum amount in an effort to control a catastrophic situation. I fail to see the responsibility in their wonderful technology allowing any of those situations to spiral – in the same way I was allowed to borrow 20 times from them! And yes I know, I am as much to blame, as are the others – we are all idiots in this together.

To be fair Wonga are no worse than the rest of the industry, but then again no better. It is why they cannot be separated from them.

Oh and yes for the record, the website http://www.saynotopaydayloans.co.uk does belong to me.

This is an interesting site, you should come share it on http://www.FollowStocks.com – It’s a social network with only Stocks. You would probably get some good conversation about Wonga.

Well it is the borrower who is making the first choice not the lender. It may be Wonga or any other. Short term loans should be regularlized at lending levels by government to have borrowers some ease.

There are so many companies offering the same policy of short-term cash advances to UK consumers online. The only thing which separates Wonga from the other companies is that it has been recognised by several award schemes such as Red Herring Europe 100 and the National Business Awards.

I agree with (short term cash loans) that the borrower has to make the first choice and not the company who is give the loan.

Wonga is offering the same loans as other companies do, but the only different thing is Wonga advertise more and the costumer services are good.

My honest regret for not expressing gratitude to you earlier. I have read other articles of Wonga. This company is actually offering so many good loan offers. I am very much pleased with the contents you have mentioned. I wanted to thank you for this great article. I enjoyed every little bit part of it and I will be waiting for the new updates.

Your offers are simply attractive. But it’s completely depends on the customers requirement that what kind of loan he want. Anyway I really like your writing skills.

I think if wonga is offering such a great deals and if it ask for more security funds than it would result in a “perfect storm†of bad debts.