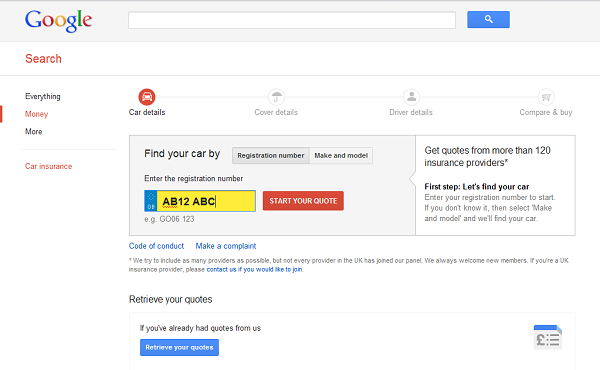

The Telegraph has been taking a look at Google’s new car insurance comparison service, and how it thinks it could get you the best deal for your car insurance.

Notice how I say best deal, rather than cheapest. Comparison sites’ focus on price is one area where Google suggests that the market can be made fairer for the customer; by having no frills policies, with high excesses as default, for example, can lower the premiums, but don’t necessarily offer the consumer the policy that most closely meets their requirements. Often the first a customer will know about a high excess is when they come to make a claim.

Other features of a car insurance policy, such as courtesy cars or breakdown cover, could be removed from the policies to make the premium as low as possible.

Google also claims that some comparison sites will happily sell your contact details to third-parties, such as insurers or claims management companies, to recoup some of the money spent on generating traffic.

For most comparison sites, selling your data to an insurer, normally the one offering the lowest premium for the product you’re comparing, is the business model. But if this is the case, you should be made aware this is going to happen at the point you submit your details. Sadly, this is often not made clear by sites as they fear it will reduce the number of people agreeing to continue in the quote process.

Finally, Google also warns about the impartiality of comparison sites, given that several are wholly or partly owned by insurers. Confused.com, CompareTheMarket.com and GoCompare.com all have big backing from insurance companies.

Google claims that it will avoid the pitfalls above by giving the user complete control over the features they quote for, which they hope will lead to them getting a policy which more closely meets their requirements. They also say they will not sell the data gathered in the quote process to insurers or any other third parties.

They intend to keep a close eye on the insurers they use to power their car insurance quote engine, and will publish a code of conduct which they must adhere to, or they’ll be removed from their panel.