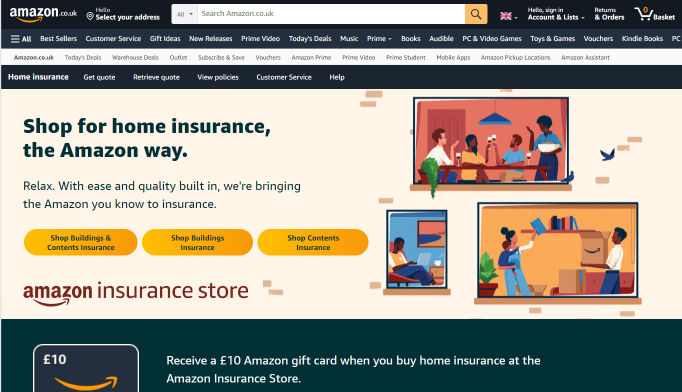

The Amazon Insurance Store is touted as a “one-stop shop for comparing and purchasing insurance policies”. You can request quotes from multiple insurers, although the list is pretty small currently, compare their prices and coverage, and then complete the purchase of a policy all on the Amazon website, using your existing Amazon account and payment methods.

Currently, the Amazon Insurance Store offers home insurance (buildings, contents, or combined buildings and contents), but they intend to expand policy selection to other insurance types in the future.

To request insurance policy quotes, visit the Amazon Insurance Store and select the type of insurance you’re interested in. You’ll be asked to provide some basic information about yourself and your property, and then you’ll be able to see quotes from multiple insurers.

Once you’ve found a policy that you’re interested in, you can read the policy details and then purchase the policy online. You can pay for your policy with a credit card or debit card, and you can choose to pay monthly or annually.

Here are some of the claimed benefits of using the Amazon Insurance Store:

- Convenient: You can compare and purchase insurance policies all on the Amazon website, using your existing Amazon account and payment methods.

- Easy to use: The process of requesting quotes and purchasing a policy is simple and straightforward.

- Competitive prices: You can compare quotes from multiple insurers to find the best price for your needs.

- Wide selection of policies: The Amazon Insurance Store offers a wide variety of insurance policies to choose from, including home insurance, car insurance, and life insurance.

- Trusted insurers: The Amazon Insurance Store only works with reputable insurers, so you can be sure that you’re getting a quality policy.

However, there are also some drawbacks to purchasing insurance through Amazon. One drawback is that you may not have as much control over the policy as you would if you purchased it directly from the insurer. For example, you may not be able to choose your excess or add certain coverages.

Another drawback is that Amazon’s customer service for insurance is a bit of an unknown at this point. If you have a question or problem with your insurance policy, you may have to wait a long time to get a response from Amazon.

Overall, the Amazon Insurance Store is a convenient and affordable way to purchase insurance. However, it is important to weigh the benefits and drawbacks before making a purchase.

Here are some additional things to consider when purchasing insurance through Amazon:

- Make sure you understand the terms and conditions of the policy before you purchase it.

- Read the reviews of the insurer before you purchase a policy.

- Keep good records of your claims and payments.

- If you have a problem with your policy, contact Amazon customer service first. If you are not satisfied with their response, you can contact the insurer directly.

- Limited panel of insurers, so you’re not getting as good coverage than if you used other comparison sites, such as Moneysupermarket.com or confused.com